Investors often hang on the words of Wall Street analysts like sailors awaiting a favorable wind, but should these whispers guide your hand in the tempestuous seas of the stock market?

Before we delve into the reliability of brokerage recommendations and how to wield them as a tool, let’s take a peek at what these financial soothsayers are saying about the tech giant, Teradyne (TER).

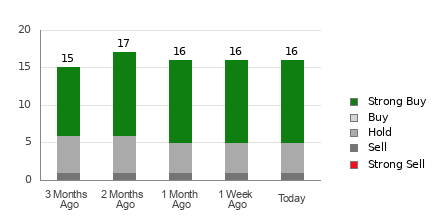

Teradyne currently rests beneath the warm embrace of an Average Brokerage Recommendation (ABR) of 1.69, nestled snugly between a Strong Buy and a mere Buy on the 1 to 5 scale of analyst opinions, lovingly curated by 16 brokerage firms.

Within this trove of wisdom, 11 hushed but strong affirmations ring out – echoing the sentiment that 68.8% of these luminaries bestow upon Teradyne the coveted title of Strong Buy.

Decoding the Dance of Broker Recommendations for TER

The consensus whispers advise embracing Teradyne with open arms, yet treading solely on this path into the mystical realm of investments may not prove to be a bountiful voyage. Studies suggest that the words of brokerage firms, steeped in bias for the stocks they cherish, often paint an overly rosy picture.

Why, you ask? These analysts lean heavily towards showering lavish praise upon the stocks under their purview, flashing five “Strong Buy” badges for every paltry “Strong Sell” that dares to raise its feeble voice.

This lopsided love affair raises doubts about the alignment of interests between these financial fortresses and the humble retail investor, leaving the future of a stock’s trajectory shrouded in mystery. Perhaps it’s prudent to wield these whispers as but one tool in a chest filled with pearls of wisdom for the discerning investor.

Our trusty divining rod, the Zacks Rank, stands shoulder to shoulder with a countless horde of stocks, offering a solid vantage point for those seeking clarity amidst the chaos of market dynamics. Aligning the Zacks Rank with the ABR could serve as a beacon in the night, guiding the determined investor towards the shores of profitability.

ABR: The Decoy Doused in Zacks’ Magic

Amidst the hubbub of numbers, the Zacks Rank stands apart in its solemn duty to decipher the cryptic whispers shrouding the stock market, turning its gaze towards the dance of earnings estimate revisions. While ABR frolics in decimals, the Zacks Rank marches forth in whole numbers, offering a divergent path for the weary traveler seeking truth amidst the murkiness of investments.

Brokers, draped in the colors of vested interests, often emit a siren’s call through their recommendations, leading investors astray more often than guiding them towards safe harbors. Yet, deep within the heart of the Zacks Rank lies a sturdy vessel built upon the waves of earnings estimate revisions, riding the currents towards the isles of near-term price movements.

Diverging further, the Zacks Rank illuminates all corners of the market, its light shining equally upon each stock under the scrutiny of brokerage analysts. Through this balance, a symphony of truth emerges, resonating with the winds of financial integrity.

The sands of time sweep differently under the feet of ABR and Zacks Rank. While ABR may languish in the shadow of obscurity, the Zacks Rank dances to the beat of the earnings revision drummers, swiftly painting a picture of the future in the swirling mists of the market.

Is TER a Gem in the Investment Mine?

Gazing upon the stars of earnings estimate revisions for Teradyne, the Zacks Consensus Estimate for this year stands firm at $3.04, unmoved by the winds of change over the past month.

Faithful to this stance, analysts whisper in hushed tones of the company’s earnings panorama, painting a portrait of stability reflected in a Consensus Estimate frozen in time. This tableau has etched a Zacks Rank #3 (Hold) upon Teradyne, inviting the wary navigator to tread cautiously upon the seas of investment.

Therefore, as you ponder the siren call of a Buy-equivalent ABR for Teradyne, remember to temper your steps with caution, for the tides of the market can be as capricious as the furies of ancient gods.

Top 5 Dividend Stocks for Your Retirement

Zacks beckons to you with tales of 5 stalwart companies, grounded in tradition and adorned with dividends. These titans of industry promise a future rich in bounty, a rare gift in the churning waters of financial planning.

Peer into this treasury of wisdom; the report is freely yours to explore >>