Preview: Today, we will discuss the catalysts and the “smart money” buying the MSCI Argentina ETF (ARGT), Russell 2000 Index ETF (IWM), iShares Bitcoin Trust ETF (IBIT), Alibaba (BABA), and JD.com (JD).

Unveiling the Wise Investor Moves

On Wall Street, numerous distractions clamor for attention. Amidst the chaos, establishing a robust investment framework becomes paramount. Filtering out the noise, while tapping into insights from insiders and shrewd traders, can fortify an investor’s conviction. Let’s explore two strategies to track the “smart money.”

1) Monitoring 13F Filings

Institutional money managers must file a 13F report detailing their holdings with the SEC. Although retail investors may not match the timing of these trades, insights gleaned from these filings can provide a glimpse into investment rationale and the level of conviction held by these investors.

2) Spotlight on Insider Purchases

Monitoring insider buying activities can offer a strategic advantage. Insider purchases typically carry more weight than sales since they signal a belief in future stock price appreciation. This asymmetry underscores the significance of insider sentiment in investment decisions.

Stanley Druckenmiller: A Maverick Visionary

Long revered in financial circles, Stanley Druckenmiller’s uncanny foresight and cross-asset acumen have set him apart. With a track record of unparalleled consistency, Druckenmiller recently made notable moves in Argentine and U.S. small-cap equities, underlining his knack for spotting lucrative opportunities.

Argentina’s Evolutionary Trajectory

Driven by Argentina’s fresh free-market mandate, Druckenmiller’s investment thesis underscores a shift towards market-oriented policies. Anticipating a surge in Argentine equities post years of socialism, Druckenmiller’s strategic alignment reflects a compelling narrative of transformation and growth.

ARGT ETF: Riding the Momentum Wave

The ARGT ETF encapsulates a basket of Argentine stocks, providing U.S. investors with exposure to Druckenmiller’s bullish outlook. Displaying robust performance, ARGT has surged by 23% year-to-date, showcasing the resonance of Druckenmiller’s conviction.

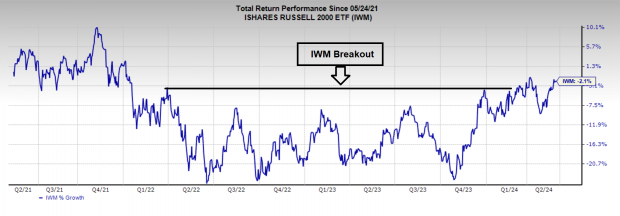

Small Caps: Embracing Market Mean Reversion

Embracing small-cap equities through a call options play on the Russell 2000 Index ETF (IWM), Druckenmiller underscores a contrarian view on the potential resurgence of small caps to historical norms.

Catalyst: Navigating Interest Rate Dynamics

As interest rate uncertainties loom, the prospect of rate cuts presents a silver lining for small caps. With inflationary pressures abating, a potential inflection point emerges, hinting at a paradigm shift. Visualizing a significant breakout in IWM, the narrative echoes the timeless Wall Street maxim, “The longer the base, the higher in space.”

Image Source: Zacks Investment Research

Bitcoin ETFs: Piquing Institutional Interest

The approval of spot Bitcoin ETFs heralded a new chapter in institutional adoption of cryptocurrencies. The influx of institutional players into Bitcoin ETFs, including IBIT, underscores a growing appetite for digital assets, with Bitcoin poised to leverage forthcoming tailwinds such as the “halving.”

Michael Burry & David Tepper: Mavericks of the Trade

Steering through financial waters with unique insights, Michael Burry and David Tepper

Investment Titans Making Bold Bets

Mastering the Art of Contrarian Investing

Michael Burry and David Tepper have carved a niche for themselves in the world of finance by making audacious contrarian bets that often pay off handsomely. Burry gained widespread acclaim for his accurate prediction and subsequent shorting of the market leading up to the Global Financial Crisis in 2008. This feat was immortalized on screen with Christian Bale portraying him in “The Big Short.” Meanwhile, Tepper made bold investments in major banks like Bank of America during the crisis, foreseeing government intervention to prevent their collapse, a move that propelled him to extraordinary wealth, eventually enabling him to acquire the Carolina Panthers.

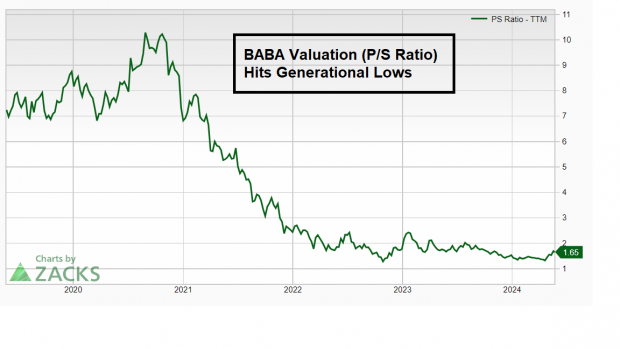

China and Alibaba (BABA): A Contrarian Bet

Burry and Tepper are now setting their sights on a potential turnaround in China, particularly in the e-commerce sector. Burry has taken significant positions in JD.com (JD) and Alibaba (BABA), with Tepper also holding a substantial stake in Alibaba. Alibaba, in particular, stands out due to noteworthy insider purchases by the likes of Founder and CEO Jack Ma, amounting to over $100 million in BABA stock. Additionally, the company’s current valuation presents an attractive opportunity for these seasoned investors.

Image Source: Zacks Investment Research

Insider Insights and Market Trends

This quarter’s 13Fs and insider purchases provide valuable insights into the strategic moves made by savvy investors like Burry and Tepper. Argentina, small-cap stocks, Bitcoin, and the Chinese market are areas of interest that deserve close monitoring as they could shape future investment trends.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts have identified picks with the potential to soar more than 100% in the coming months. Director of Research Sheraz Mian has singled out a company that targets millennial and Gen Z demographics, boasting nearly $1 billion in revenue in the last quarter alone. The current dip in its stock price presents an opportune moment to consider an investment, bearing in mind that not all recommendations guarantee success, yet this particular choice could outperform previous Zacks’ standouts like Nano-X Imaging which saw a remarkable surge of +129.6% in just over 9 months.