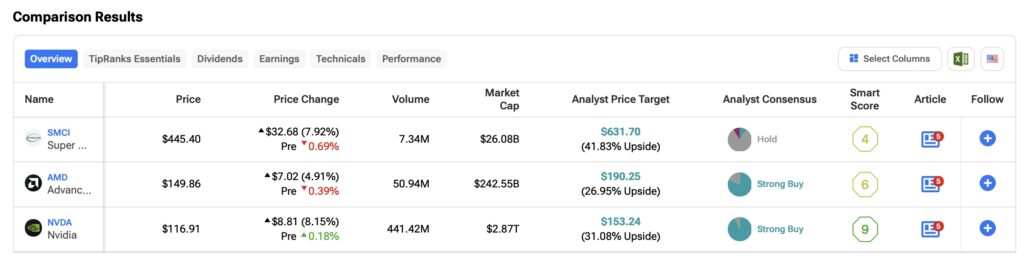

Amidst the buzz surrounding advanced computing and artificial intelligence, choosing the right chip stock for investment can be akin to navigating a complex maze. In this analysis, we pit three key players – Super Micro Computer, Advanced Micro Devices, and Nvidia – against each other using the TipRanks Stock Comparison Tool. Let’s delve into why Nvidia, a stock I currently rate as a Buy, emerges as the top choice for investors, while I maintain a Hold position on Super Micro Computer and AMD.

Before delving into the comparison, let’s establish the roles of each company. While NVIDIA and AMD specialize in graphics processing units (GPUs) that power servers and data centers, Super Micro Computer provides the essential infrastructure on which these technologies operate.

Super Micro Computer (SMCI)

Super Micro Computer shows promising growth potential. Revenue surged by an impressive 109.7% over the past year, driven by heightened demand in the AI sector. Despite revenue growth projections of 88.3% for the current year, challenges loom large. The company faces allegations of accounting manipulation by Hindenburg Research, triggering a plunge in its stock price and casting doubts on its management integrity. Following the report, Super Micro Computer opted to delay the release of its annual report.

Assessing SMCI’s Viability

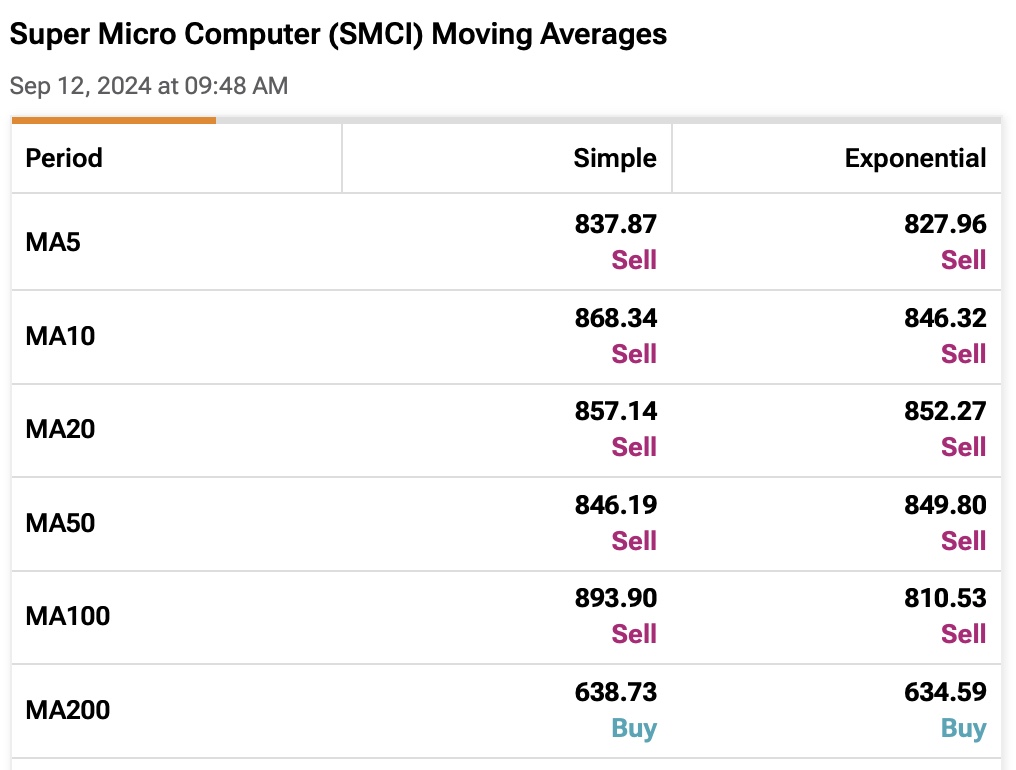

The current climate at Super Micro Computer paints it as a risky investment, hence my stance as Hold. However, with the stock trading at a considerable discount from its peak earlier this year, it might offer a buy-the-dip opportunity should the allegations prove baseless. Momentum indicators suggest a bearish trend in the short to medium term, yet an oversold position may entice contrarian investors looking for potential gains.

Despite recent analyst downgrades, Wall Street’s sentiment on SMCI remains optimistic, with a consensus rating of Moderate Buy and an average price target of $978.50, hinting at a substantial upside potential.

Nvidia (NVDA)

Nvidia stands out as a technology powerhouse, reigning supreme in the AI domain. With pivotal chips crucial for advanced AI systems and data centers, the company commands a staggering 98% of the data-center GPU market. This dominance, coupled with stellar earnings growth, solidifies my bullish outlook on the stock.

In the last year, Nvidia witnessed a remarkable 194.7% spike in revenues, accompanied by a staggering 394.2% surge in earnings. Analysts predict a 106.1% revenue growth for the current year, amounting to $125.58 billion, along with a projected 119.2% increase in earnings per share.

Evaluating NVDA’s Potential

Nvidia unequivocally earns a Buy rating. Betting against this industry titan seems ill-advised, especially considering the stock’s 140% surge this year. While recent results hint at a potential growth moderation, the long-term outlook for Nvidia remains robust.

Investors should brace themselves for short-term fluctuations in Nvidia’s stock, given its recent uptrend. Technical indicators suggest bearish trends in the near to medium term, although long-term signals remain bullish, implying sustained profitability for long-haul Nvidia investors.

The Battle of the Chip Titans: Nvidia, AMD, and Super Micro Computer

Wall Street’s affection for Nvidia remains unwavering, with 39 out of 42 analysts backing the stock with a Buy rating. The average price target for Nvidia stands at $153.24, indicating an enticing 31.08% upside potential.

Contrasting Fortunes: Advanced Micro Devices (AMD)

My decision to maintain a Hold rating on AMD revolves around the company’s lukewarm financial growth. AMD’s recent revenue uptick of 6.4% and a 30.5% surge in earnings over the past year pale in comparison to the roaring success of its archrival, Nvidia. This lag stems from AMD’s steadfast emphasis on hardware efficiency.

Analysts foresee a 13% revenue boost for AMD this fiscal year, reaching $25.62 billion, coupled with a 27.6% profit increase per share. However, despite the optimistic outlook, recent figures from AMD disappoint. Although Q2 witnessed a 115% revenue spike in its Data Center segment, the chip and processor revenue for video game consoles plummeted by 59% to $648 million. In stark contrast, Nvidia saw a 16% year-over-year surge in gaming revenues. These disparities hint that AMD may not be the most alluring microchip player in the current market.

Investor Tug-of-War: Is AMD Worth the Play?

Further reinforcing my Hold stance on AMD is the firm’s recent acquisition of ZT Systems for $4.9 billion, funded in a 75% cash and 25% stock ratio. The purchase has raised concerns about potential stock dilution, which could cast a shadow on annual earnings. In a lackluster performance, AMD’s shares have inched up by less than 10% this year, trailing numerous peers and the tech-heavy Nasdaq index, which has boasted a 20% rise year-to-date.

Regarding momentum indicators, the short-term signals point to a Buy, while medium- and long-term signals suggest a Sell stance. This dichotomy indicates that although short-term gains might be within reach, cautious optimism is advised for long-term investors due to bearish undercurrents.

Verdict: Cellular Shifts in the Chip Space

Despite each company—Super Micro Computer, Nvidia, and AMD—flaunting distinct merits, Nvidia, with its prolific presence in AI and robust growth trajectory, emerges as the most tantalizing investment prospect. Super Micro Computer and AMD should be met with circumspection, given the underlying challenges that each entity faces. Evaluating the triad of chip stocks, Nvidia shines brightest, wielding a supremacy in both operational performance and market prospects.