As spring blooms in the Northeast and the second quarter unfolds, the financial markets are experiencing their fair share of turbulence. Despite robust earnings growth from major corporations, the specter of heightened interest rates continues to cast a shadow over certain sectors.

The Struggle of Solar Stocks

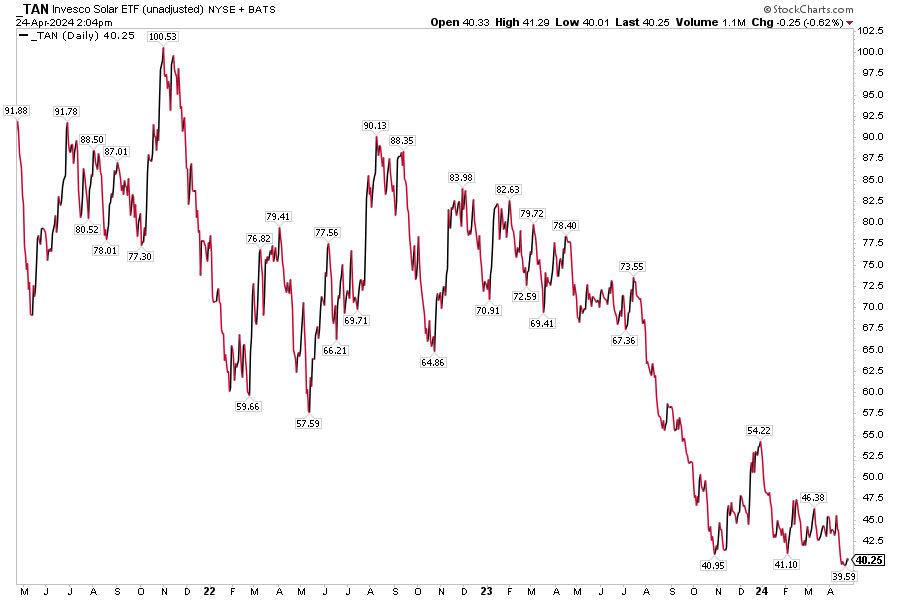

Amidst this backdrop, the solar industry stands out as particularly vulnerable to the current economic climate. Since the ascent of interest rates in late 2021, solar stocks have faced considerable challenges, with borrowing costs exerting significant pressure on the sector.

Companies like Invesco Solar ETF (NYSE:) have been especially sensitive to fluctuations in US Treasury bond yields. When interest rates spike, these stocks tend to suffer – a trend that often reverses when rates recede.

It remains uncertain when this intricate relationship between interest rates and solar stocks will break. Investors await upcoming quarterly reports, shareholder meetings, and corporate conferences in May for insights from key industry players.

TAN Solar ETF Struggles Amid Market Pressures

Source: Stockcharts.com

Challenges Faced by Enphase Energy

Enphase Energy (NASDAQ:) recently faced a significant setback, with its Q1 earnings missing Wall Street expectations. Despite revenue falling short and guidance being revised downward due to softer domestic demand, the company saw a surge in sales growth in Europe.

First Solar’s Upcoming Earnings and Shareholder Meeting

Concerns persist for solar stocks as First Solar (NASDAQ:) prepares to report its Q1 2024 earnings. The industry awaits insights from the company’s annual shareholder meeting as well as earnings calls from other key players like SolarEdge Technologies (NASDAQ:) and Sunrun (NASDAQ:).

Insights from Industry Conferences

Industry conferences like Citi’s 2024 Energy and Climate Technology Conference and the Deutsche Bank Global Solar & Clean Tech Conference 2024 offer opportunities for executives to address current challenges and emerging trends in the solar market.

Annual Berkshire Hathaway Shareholder Meeting

Amidst the market turmoil, investors eagerly anticipate Berkshire Hathaway’s (NYSE:) annual shareholder meeting, traditionally known as “Woodstock for Capitalists.” With Warren Buffett at the helm, the meeting serves as a critical forum to gauge the company’s outlook in the face of rising interest rates.

Costco’s Foray into the Metals Market

Closing out the month, attention turns to Costco (NASDAQ:) as it provides insights into consumer spending habits through its monthly sales report. Alongside its venture into the precious metals business, investors will closely monitor how this move impacts the retail giant’s bottom line.

Final Thoughts

As first-quarter earnings reports paint a diverse picture of corporate performance, challenges persist in the solar industry due to escalating interest rates. With Berkshire Hathaway and Costco also under the spotlight, the financial landscape remains dynamic and uncertain heading into the summer months.