The Market Soars: S&P 500 Reaches Highest Daily Gain Since January 2023

Thursday on Wall Street concluded with a bright outlook, defying the recent trend of afternoon slumps. A wave of optimism swept through investors as initial jobless claims for the week came in lower than anticipated, alleviating concerns of a looming recession driven by a sustained rise in unemployment.

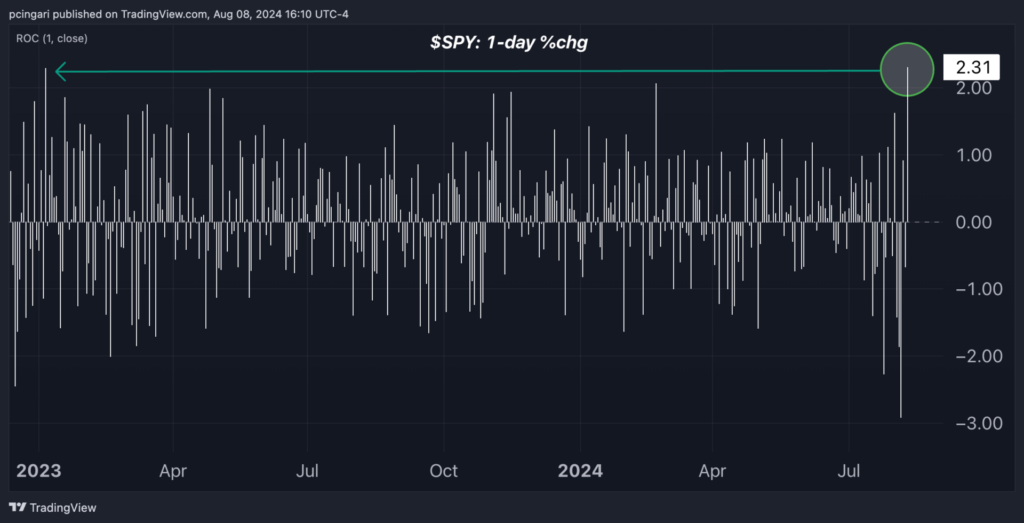

The S&P 500 index, represented by the SPDR S&P 500 ETF Trust (SPY), closed the session with an impressive 2.3% gain. This surge marked its most substantial daily uptick since January 2023.

Over in the tech sector, the Nasdaq 100 index, tracked by the Invesco QQQ Trust (QQQ), experienced a 3.1% climb, its most significant daily increase since February 2023. Despite this positive shift, the Nasdaq 100 is still down 5% from the previous week’s opening levels but has rebounded by 5.7% from Monday’s lows.

Among tech stocks, Arm Holdings plc (ARM) and Marvell Technologies Inc. (MRVL) were the stars of the day, soaring by 10.6% and 8.9%, respectively.

The rally didn’t stop there. Blue-chip stocks also posted strong gains, with the Dow Jones Industrial Average showcasing a 1.8% increase. Small caps followed suit, with the iShares Russell 2000 ETF (IWM) surging by 2.4%.

Glance at the Chart: S&P 500 Enjoys Best Day in Nearly 19 Months

Fed’s Barkin Challenges Labor Market Concerns

Richmond Fed President Tom Barkin, a key figure in the Federal Open Market Committee, shared valuable insights during a recent National Association for Business Economics call.

Barkin emphasized that while companies are slowing their hiring practices, there is no significant surge in layoffs. Data on jobless claims reflect this trend, showing a flatlining in layoff rates. Many employers are cautious about cutting staff, recalling the challenges they faced in recruitment two years ago.

Describing the current economic landscape as a gradual shift towards normalization, Barkin expressed confidence in a stable and measured approach to adjusting interest rates.

He noted shifting consumer spending patterns, indicating a more discerning clientele. Businesses that have raised prices substantially are facing a more selective customer base. “Consumers are still spending, but they’re choosing,” Barkin remarked, signaling a shift towards value-oriented purchases.

Despite a decline in inflation rates, prices remain elevated. Barkin expressed disappointment in the inflation figures over the past six months, urging further decreases to align with Federal Reserve targets. He cautioned against mid-term inflationary pressures, citing potential tensions in the Middle East impacting oil prices and ongoing concerns about limited housing supply.

Barkin stressed the importance of closely monitoring labor market and inflation indicators in the weeks ahead before considering any rate adjustments in September.