Recent surge of spin-offs outshining S&P 500 as companies opt for efficiency

Activist investors influencing uptick in spin-off activities

As traditional stock strategies falter, executives eye spin-offs for value addition

Throughout April, stock markets quivered with inflation anxieties, tinted by worrisome economic reports edging towards a specter of stagflation. Though the Federal Reserve dismissed the notion, the economic stage is set for a turbulent year if inflation lingers and GDP figures wane.

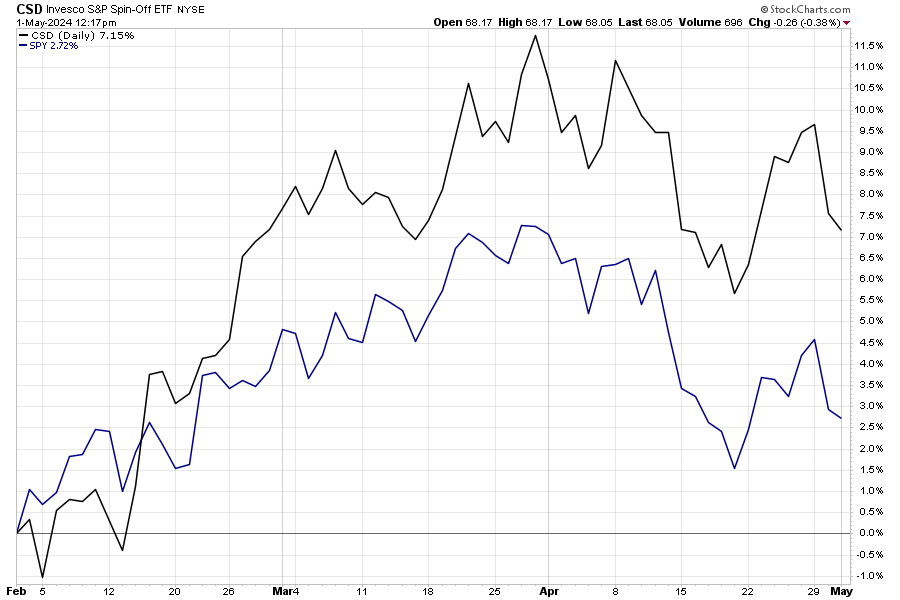

Amid sectoral downturns, notably in 11 segments with Utilities showing a modest uptick while Energy faltering, a standout performer slipped underthe market’s radar – spin-offs. Companies freshly liberated from larger entities managed to hold ground. The Invesco S&P Spin-Off ETF (NYSE:) surged over 7% in the three months leading up to May 1st, outpacing the S&P 500 by nearly five percentage points.

S&P Spin-Off ETF Gaining Primacy Since Early 2024

Source: Stockcharts.com

Why Opt for a Spin?

The advent of standalone companies provides distinct management teams an opportunity to lead with precision. Spin-offs empower parent companies to streamline core operations, enhance efficiencies, and demonstrate agility in adapting to dynamic market trends.

Strategically, spin-offs unlock value without detriment to existing shareholders, offering an efficient route for executives to divest non-essential or underperforming ventures, thus creating a nimble, more viable entity. Additionally, spin-offs may serve as a defensive shield against potential hostile takeovers aiming to dismantle standalone conglomerates.

Forget IPOs and Stock Splits, Say Hello to Spin-offs

Today’s market presents a scarcity of fresh investment prospects. While a few substantial offerings like Viking (VIK) recently made headlines, the trend leans towards U.S.-based listings over overseas options.

The IPO scene remains tepid, and the buzz around stock splits has dimmed. Two years past, high-growth firms sought to lower share prices to attract buyers. Despite sporadic splits like Walmart’s (WMT) 3-for-1 partition in February, a notable surge seems unlikely. The momentum is veering towards activist investors and private equity reserves driving the spin-off phenomenon.

Examining Recent Spin-offs

Prominent spin-offs amid a muted IPO milieu and thin stock-split activity include:

1. General Electric – GE Healthcare (GEHC) and GE Vernova (GEV)

Under pressure from Nelson Peltz at Trian Partners, GE (NYSE:) orchestrated a strategic shift through spin-offs. GE Healthcare and GE Vernova now trade publicly, with varying performances. While GE Healthcare recently stumbled post-earnings, GE Vernova exhibited strong growth since its late March unveiling. The parent company, GE, has witnessed a doubling in its share price over the year, heralding a resurgence atop the S&P 500 Industrials sector as of April 30, 2024.

2. 3M (MMM) – Solventum (SOLV)

Entrenched in legal strife over military earplugs and environmental concerns, 3M implemented a spin-off strategy, marked by a dividend cut post the healthcare unit separation. The reveal of Solventum, operating in the Healthcare Supplies sector, brought a mixed bag; while 3M’s shares soared post-Q1 results in late April, SOLV plummeted post its debut in the previous quarter.

3. Kellanova (K) – WK Kellogg

Not in the Spin-Off ETF, Kellanova (KLG) stood out as a post-September 2023 winner. Despite an initial 40% nosedive, the upswing exceeded 40%, showcasing its resilience amidst downcast trends impacting other sugary product manufacturers. Parent company Kellanova boasted strong Q1 figures last week, propelling its shares to new highs for the year.

4. Danaher – Veralto (VLTO)

Formerly tied to Danaher (NYSE:), Veralto navigated two key spheres: Water Quality and Product Quality & Innovation. While its debut was choppy akin to KLG, VLTO rebounded strongly, scaling from sub-$70 figures in Q4 last year to over $90 presently. In April, the firm touted stellar earnings and revenue numbers, currently trading at a premium valuation.

In Conclusion

The latest wave of Wall Street spin-offs crafts a compelling narrative as CEOs deliberate on capital and operational strategies amid heightened market volatility. The trend towards leaner structures, coupled with notable alpha from recent spin-offs, suggests that this corporate phenomenon is far from slowing down.