Why gold is falling … get ready for a blow-out in government spending … the world’s debt load is surging … central banks are buying gold at record levels

Short-term pain, long-term gain.

That’s the forecast for gold.

Unpacking this, let’s begin with the short-term pain.

After notching a fresh all-time high toward the end of October, the yellow metal has fallen almost 7%

Those losses accelerated following President Trump’s reelection. Behind this is a daisy chain of market repositioning anchored in one central assumption…

Trump = increased inflation and government spending.

On the campaign trail, Trump said a lot of things. Two of the most significant comments from our economy’s perspective are that he’ll lower corporate taxes from 21% to 15%, and he’ll deregulate, removing much of the bureaucratic clutter that bogs down markets.

Now, the likely impact of this is a surge in business/growth. While that’s a good thing, the market fears that such a surge will apply upward pressure to inflation.

Meanwhile, Trump’s proposed implementation of new tariffs on Chinese and European goods adds to this fear. A tariff, which is intended to protect U.S.-based companies, increases the cost of foreign goods imported into the U.S. For U.S. consumers who continue to buy those imported products, this is inherently inflationary.

So, the market is looking at the prospect of an economy juiced by lower taxes and deregulation, along with a fresh slate of tariffs, and concluding, “there’s no way inflation remains where it is today. It’s headed higher.”

In response, the market has been selling bonds (which drives prices down, sending yields up), and pushing the U.S. dollar higher.

And do you know what gold hates?

Higher treasury yields and a stronger dollar.

Higher treasury yields make gold look far less attractive since the yellow metal offers no such cash flows. This causes some investors to rotate out of gold to take advantage of the higher income payments from bonds.

Meanwhile, a strong dollar is also a headwind for gold’s price. This is because, all things equal, it requires fewer of today’s strong dollars to purchase the same amount of gold that it required with yesterday’s weaker dollars. “Fewer dollars needed” means a lower price for gold in those stronger dollars.

These are robust headwinds for gold, helping explain the gains reversal in recent days.

But the flip side of why gold is pausing today explains why gold will be rallying tomorrow.

Global macroeconomics are decidedly bullish for gold

Before we get to the “global” part, let’s begin here at home.

Earlier, I noted how Trump plans to lower corporate taxes from 21% to 15%. He’s also likely to make permanent the tax cuts from his 2017 Tax Cuts and Jobs Act. Together, this represents an enormous drop-off in government revenues.

Meanwhile, Trump has proposed deporting millions of illegal immigrants. While we don’t know the exact cost (when asked, Trump said “it’s not a question of a price tag”), it’s safe to assume it won’t be cheap – nor will the rest of Trump’s spending initiatives.

In fact, according to the Committee for a Responsible Federal Budget, based on his stated plans, Trump’s presidency is projected to add $7.75 trillion to the deficit over the next decade. The combo of “less money in” and “enormous money out” isn’t great for our nation’s financial health.

Keep in mind, this comes at a time when our nation already can’t live within its means. Our fiscal deficit – which measures how much more our government spends than has collected in taxes – clocks in a $1.83 trillion so far in fiscal year 2024. This is a record.

So, what will happen?

With far more money going out than coming in (exacerbated by Trump tax cuts), our government will have no other option than to issue more debt to fund the shortfall

Now, this debt can come from borrowing from public or financial institutions, or it can come from “open market operations” in which our government increases its money supply.

Unfortunately, our government has been engaging in open market operations for decades, which means money printing. And as you know, all things equal, more money supply erodes the purchasing power of that money supply.

Below is a chart of our nation’s money supply (M2 money stock) since 1960.

Notice two things:

- One, its curve, which is beginning to grow exponentially (dotted red line).

- Two, even though M2 fell in recent years when the Fed took steps to remove liquidity from the system after the explosion of pandemic-related money supply, M2 is now climbing again (solid red line in the red circle).

Source: Federal Reserve data

As far as the purchasing power of your savings goes, this is an enormous red flag…and gold is one of the best defenses we have against it.

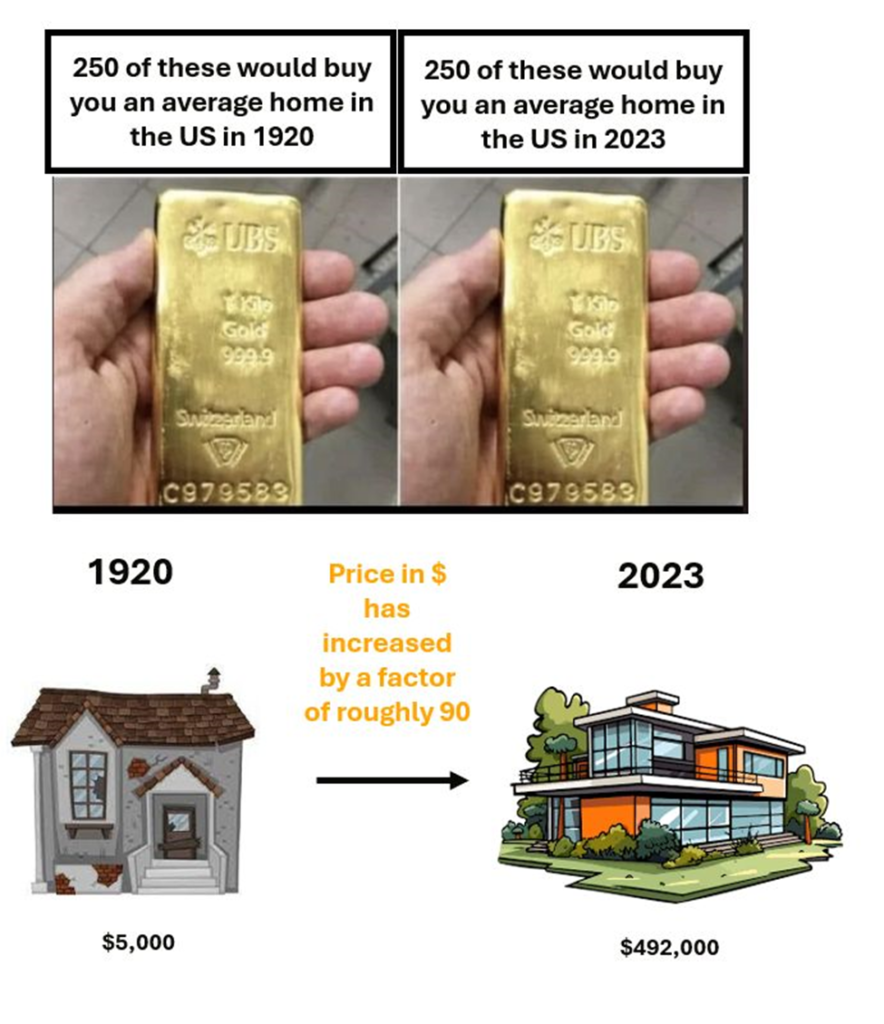

A case study in gold’s purchasing power ability

Home prices have become so expensive that they’ve priced out loads of would-be homebuyers, right?

Yes, when viewed through a “dollar” lens. No, when viewed from gold’s perspective.

Back in March, we highlighted gold’s ability to protect purchasing power by comparing it with real estate over the last 100 years. The specifics are slightly dated (gold and home prices are higher today than back in March), but you’ll get the point.

From that Digest:

The average price of gold in 1920 was $20.68 per ounce. Today, it’s worth roughly $2,100 per ounce. That’s a 100x increase.

Meanwhile, in 1920, the average house price in the U.S. was between $5,000 and $6,000. In 2023, it was $492,000. That’s in increase of roughly 80x – 100x.

Source: Charles-Henry Monchau

Pretty evenly matched, right?

Well, what’s not evenly matched is “dollars then” versus “dollars now.”

Guess how many dollars you’d need today to equal the spending power of $100 in 1920.

Ready?

$1,576.50.

That’s a 94% collapse in dollar strength in 104 years.

Now, let’s widen our perspective to the entire world…

The U.S. isn’t the only nation that is fiscally irresponsible. Here’s the International Monetary Fund from last month:

Global public debt is very high.

It is expected to exceed $100 trillion, or about 93 percent of global gross domestic product by the end of this year and will approach 100 percent of GDP by 2030. This is 10 percentage points of GDP above 2019, that is, before the pandemic…

Future debt levels could be even higher than projected, and much larger fiscal adjustments than currently projected are required to stabilize or reduce it with a high probability…

Past experience suggests that debt projections tend to underestimate actual outcomes by a sizable margin. Realized debt-to-GDP ratios five-years ahead can be 10 percentage points of GDP higher than projected on average.

Global debt is one reason why global central banks have been making record-setting gold purchases in recent years. According to BullionStar, banks set a purchasing record in 2022 (1082 tonnes of gold), nearly topped that amount in 2023 (1037 tonnes), and here in 2024, we’re on pace to set a new all-time high.

Here’s MarketWatch:

Gold prices are rising because central banks are buying — likely diversifying away from U.S. Treasurys amid worries about the U.S. fiscal situation [says] Torsten Slok, chief economist at Apollo Global Management…

Central banks remain the “biggest story” for gold over the last two years, said Joe Cavatoni, senior market strategist at the World Gold Council.

Bottom line: Our world is drowning in debt. Global central banks see this and are actively loading up on gold reserves with one hand, while putting their finger on the money printing press with the other.

Putting it altogether…

In the short-term, we’re likely to see continued headwinds for gold. Beyond rising treasury yields and a strengthening dollar, this is happening because investors are cannonballing into risk-on assets.

Gold, as a defensive asset, is seeing heavy outflows. Investors should prepare for a continued breather.

But the financial situation for our nation – and the world – is horrendous and growing worse. More debt spending is coming… more currency debasement is coming… and we haven’t even discussed the potential for the geopolitical conflict that could be coming (supportive for gold’s price).

Here’s our takeaway:

Yes, get into top-tier AI stocks… yes, look at quantum computing, robotics, nuclear, and the rest of tomorrow’s next-gen trends… yes, position yourself for the Trump trade (on that note, here’s how legendary investor Louis Navellier is doing that) …

But don’t overlook gold. As far as the purchasing power of your savings goes, it’s a financial life-preserver in a time of heavy debt spending, inflation, and currency debasement. So, if we see some substantial selloffs in the coming weeks, view it as the opportunity that it is.

Have a good evening,

Jeff Remsburg