Last week of August unfolded to tech investors eagerly awaiting major company results.

Meanwhile, Bitcoin and Ether prices dipped, and Google’s NASDAQ:GOOGL Gemini platform received a boost with two new features.

OpenAI made headlines discussing a significant funding round, potentially becoming the highest-valued AI startup.

Stay in the know about the tech world’s latest with the Investing News Network’s round-up.

1. Tech Sector Performance in August

Technology sector exhibited mixed results in the last week of August as NVIDIA (NASDAQ:NVDA), Dell (NYSE:DELL), and Crowdstrike (NASDAQ:CRWD) awaited earnings reports.

Starting strong, Nasdaq Composite (INDEXNASDAQ:.IXIC) and S&P 500 (INDEXSP:.INX) faltered on Monday with a chip stock selloff dragging the Nasdaq down by 0.63 percent.

The trend continued on Tuesday with both indexes opening slightly lower and edging up midday, only to close 0.57 and 0.18 percent down, respectively.

Turbulent Times for Tech Stocks

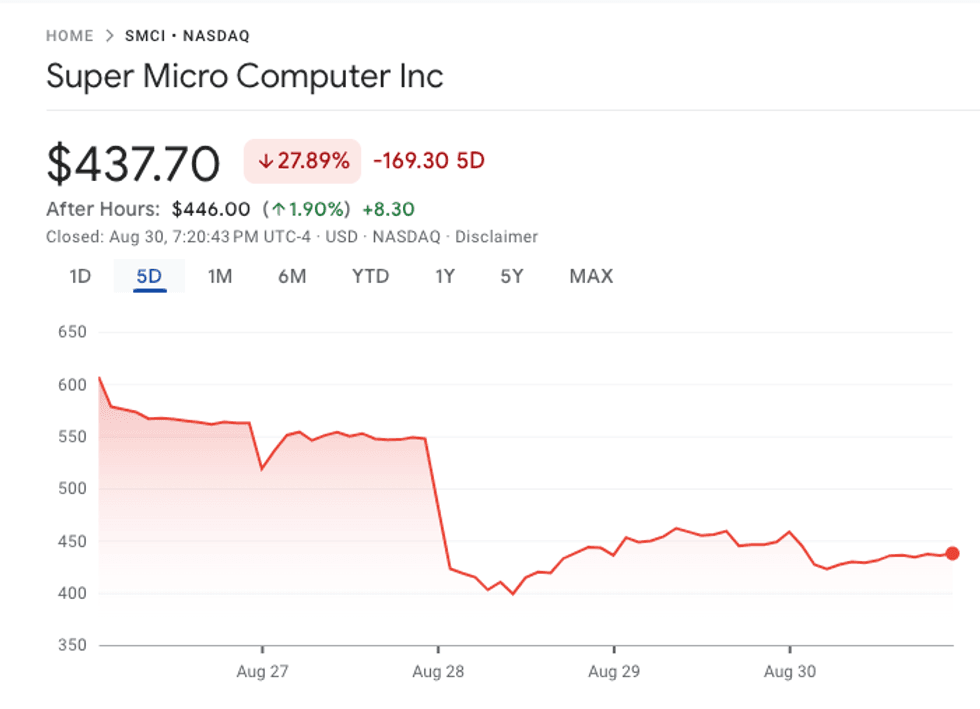

Chart via Google Finance.

Super Micro Computer performance, August 26 to August 30, 2024.

Wednesday saw S&P 500 up by half a percent and Nasdaq Composite by over a full percentage point on expectations of a strong NVIDIA showing. However, Super Micro Computer’s share price plummeted over 17%, dragging the index down.

Super Micro’s announcement of delaying the 10-K form filing for its 2024 fiscal year to assess internal controls over financial reporting led to a 0.9% drop in the first two hours of trading and ended 1.23% below its opening. Tech stock losses extended to after-hours trading.

Thursday’s market uptick followed initial US jobless claims data indicating claims slightly under expectations.

Weekly Financial Highlights: Surges, Plummets, and Reveals

A Bright Start: Positive Economic Indicators

The market witnessed a surge this week as the GDP growth for the second quarter exceeded expectations. The S&P 500 held steady, but the Nasdaq Composite took a hit, dropping by 0.73 percent to close at 17,482.6, primarily due to AI-related stock declines.

On Friday, the US released the latest data on personal consumption expenditures, showing a rise in consumer spending in July, signaling a robust end to the summer season. All major indexes closed near record highs, with the Nasdaq-100 up by 1.29 percent, the S&P 500 by 1.01 percent, and the Nasdaq Composite by 1.13 percent.

Bitcoin and Ether: A Rollercoaster Week

Both Ether and Bitcoin started the week with declines after maintaining gains from the previous week. Ether opened at US$2,700, and Bitcoin at US$63,500, but both experienced swift losses, with Ether dropping by 11.53 percent and Bitcoin by 8.68 percent by Tuesday evening due to profit-taking following a weekend rally.

While Bitcoin made a slight recovery midweek, struggling to stay above US$60,000, Ether remained below US$2,600 throughout the week. By Friday, Bitcoin had dropped by 2.84 percent, ending the week at US$59,200. Ether also fell, losing over 3 percent in the afternoon, and 8.5 percent for the week.

Tech Earnings: NVIDIA, Crowdstrike, and Dell

This week brought a wave of earnings reports from tech giants, with NVIDIA and Crowdstrike sharing results on Wednesday, and Dell following on Thursday. NVIDIA, known for its recent revenue growth, reported revenue exceeding US$30 billion for the second quarter of 2025, slightly below expectations, hinting at a potential AI slowdown.

Investors expressed disappointment as NVIDIA’s shares fell by 1.94 percent, extending to a 7.9 percent drop for the week. In contrast, Crowdstrike surpassed estimates with quarterly revenue hitting US$963.9 million, a significant increase compared to the previous quarter, pushing its share price up by 2.62 percent.

Meanwhile, Dell reported an 80 percent growth in server sales from a year ago in its second quarter of 2025, prompting an increase in full-year revenue guidance. Dell adjusted its range to US$95.5 billion to US$98.5 billion from US$93.5 billion to US$97.5 billion.

Revolution in Tech: Notable Developments in Company Performance and Innovations

New Heights in Share Performance

With a remarkable surge, shares have climbed an impressive 54.49 percent year-to-date, marking a significant uptick of 4.33 percent just within the week.

OpenAI Pursues Billions in Fresh Funding

OpenAI is making waves in the financial realm as reports suggest the company is on the brink of securing several billion dollars in a fresh funding round, spearheaded by none other than Thrive Capital.

The investment landscape is abuzz with speculation as Thrive Capital prepares to inject a substantial sum of US$1 billion into OpenAI. Not to be outdone, prominent tech giants such as Microsoft, Apple, and NVIDIA are also rumored to be considering significant contributions.

While official statements from the involved parties have yet to materialize, insiders have disclosed that OpenAI’s CFO, Sarah Friar, communicated the funding drive to staff through an internal memo issued midweek. Should this funding effort come to fruition, OpenAI is poised to be valued at over US$100 billion, overshadowing its competitors as the highest-valued AI startup in history.

Google Introduces Innovative Gemini Features

In a dynamic display of innovation, Google unveiled two groundbreaking features tailored exclusively for Gemini Advanced Business and Enterprise subscribers earlier this week.

The introduction of Gems, customizable versions of Gemini geared towards specific objectives, was an instant hit following its unveiling in the company’s press release. Complementing these Gems are a series of preloaded Gem variants including a learning coach, a brainstormer, a career guide, a writing editor, and a coding partner.

Not stopping there, Google announced the soon-to-be-released Imagen 3, its latest image-generation model that promises to redefine image quality standards. Promoted as capable of generating images with minimal linguistic cues and across various artistic styles, Imagen 3 is set to hit the market in the upcoming days, a concept first showcased at the Google I/O event held back in May.

Stay updated with real-time tech news by following us on Twitter @INN_Technology!