Remember the term “Magnificent Seven” in 2023 when the stock market was riding high? The tech behemoths, including Amazon, Apple, Alphabet, Meta Platforms, Microsoft, Nvidia, and Tesla, enthralled investors with their futuristic ventures in AI and cloud services. Fast forward to 2024, and the same stars no longer shine as brightly. Two of them, Apple and Tesla, have veered off track, stirring speculation amongst market watchers. Let’s delve into the highs and lows.

Image source: Getty Images.

The Disappointing Decline

Among the elite, Apple and Tesla have been the underperformers recently. Apple, known for its iconic products like the iPhone, and the electric vehicle pioneer, Tesla, have seen their stock prices tumble by 11% and 32% respectively since the beginning of the year.

Strikingly, these downward spirals haven’t only affected the companies themselves but have also cast shadows on the overall market performance. Together, these two heavyweights contributed to a negative 1.3 percentage point drag on the S&P 500 in the first quarter, as per Statista’s analysis.

The decline stems from various factors impacting investor sentiment towards Apple and Tesla. Apple, despite its historic success, faces scrutiny for lagging in innovative breakthroughs. On the other hand, Tesla’s profitability is marred by cost-cutting strategies and stiff market competition.

Challenges for Tesla

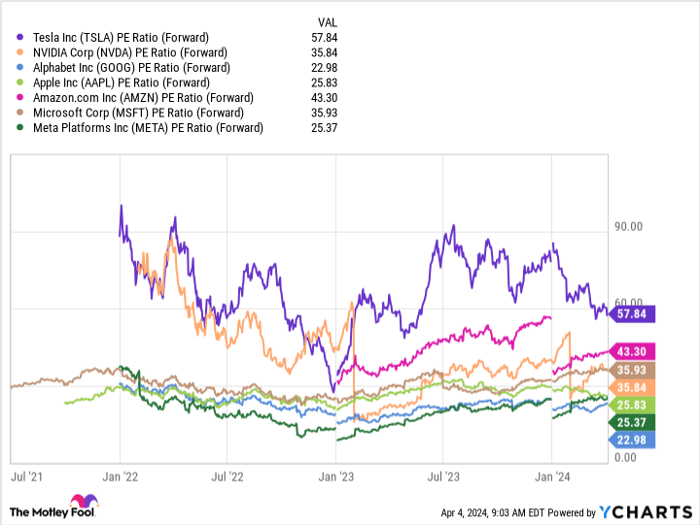

Tesla’s profitability is further clouded by its lofty 57x forward earnings multiple, making it the most expensive stock amongst the “Magnificent Seven.” Such steep valuations could hamper investor interest and potentially divert attention to more attractively priced counterparts in the same league.

TSLA PE Ratio (Forward) data by YCharts

While Apple and Tesla struggle to regain their footing, Nvidia has emerged as the star performer, driving significant gains for the S&P 500 with its robust financials and promising product launches. Intriguingly, the AI chip market dominance held by Nvidia hints at a potential windfall as the AI industry is slated to reach new heights.

Other stalwarts like Microsoft, Meta, and Amazon, focusing on AI investments, have also attracted investor interest, signaling a shift towards AI-centric enterprises.

Looking Ahead for Apple and Tesla

Are Apple and Tesla at the end of their tether? Not necessarily. Despite current woes, both companies possess strong fundamentals that could propel them to future success. Apple’s formidable brand presence and burgeoning services segment signify resilience, while Tesla maintains its EV supremacy and ongoing technological advancements.

Although the spotlight currently shines harshly on Apple and Tesla, the long-term narrative may witness a reversal, spelling hope for their dedicated stakeholders.

Should you invest $1,000 in Apple right now?

Prior to diving into Apple stocks, consider this:

Unveiling the Elite Selection: Top 10 Stocks for Savvy Investors

Do you ever wonder about the 10 best stocks to invest in right now? Strangely enough, Apple is conspicuously absent from this exclusive list. These top picks are not just any ordinary stocks; they are the cream of the crop, poised to potentially yield astronomical returns in the years to come.

The Stock Advisor Breakdown

Stock Advisor is like a map guiding investors towards treasure troves of success. Its clear-cut strategy assists in constructing a well-balanced portfolio. Regular insights from experts, coupled with two fresh stock recommendations each month, help investors navigate the convoluted waters of the stock market. What’s even more impressive is that Stock Advisor has remarkably outshined the S&P 500 by more than threefold since its inception back in 2002.

Actionable Insights for Investors

Curious to see the 10 stocks that have passed the stringent criteria? Look no further. These top-tier selections have been meticulously chosen to provide potential windfall gains to investors who are astute enough to recognize their promise.

Author’s Disclosure and Board of Directors’ Affiliations

It’s interesting to note that esteemed personalities such as John Mackey, the erstwhile CEO of Whole Foods Market under the Amazon umbrella, are part of The Motley Fool’s board of directors. Likewise, Randi Zuckerberg, the former director of market development and spokesperson for Facebook, who also happens to be the sister of Meta Platforms CEO Mark Zuckerberg, holds a position on the board. Additionally, Suzanne Frey, an executive at Alphabet, adds her expertise to the board makeup.