In today’s world, where the priority of weight loss has transcended mere trendiness to become a fundamental health concern, the demand for GLP-1 drugs, known for their effectiveness in weight management, is projected to soar. Experts anticipate the market for these drugs to reach approximately $133 billion by 2030, growing at a robust compound annual growth rate (CAGR) of 20%.

Key industry players like Novo Nordisk (NVO), Eli Lilly and Company (LLY), Costco Wholesale Corporation (COST), and Hims & Hers Health, Inc. (HIMS) are actively involved in the development and distribution of GLP-1 drugs. The grocery giant, Kroger Co. (KR), has recently entered this arena, leveraging its “Food as Medicine” ethos to democratize access to GLP-1 drugs.

The Legacy of Kroger Stock

Established in 1883 and headquartered in Cincinnati, The Kroger Co. (KR) boasts a massive retail footprint with 2,722 supermarkets nationwide. From organic produce to automotive products, Kroger caters comprehensively to consumer needs through a diverse range of offerings.

Kroger’s forward-thinking approach is exemplified by its integration of technologies like artificial intelligence (AI) into its operations, enhancing customer experiences and operational efficiency.

Berkshire Hathaway’s continued confidence in Kroger, evident by its equity holdings in the company dating back to the fourth quarter of 2019, underlines the grocery giant’s enduring appeal. At the end of Q1 2024, Berkshire owned around 50 million shares of Kroger, valued at $2.5 billion.

With a market cap of $36.2 billion, Kroger stock has seen a 10.5% rally over the past year and a 13% increase in the last six months.

Kroger’s impressive track record includes 16 consecutive years of dividend growth. A recent quarterly dividend payment of $0.29 per share and an annualized dividend of $1.16 per share with a 2.31% yield make Kroger appealing to income-focused investors. The company’s conservative payout ratio of 22.71% allows room for potential growth and increased dividends.

Valued at 11.59 times forward earnings and 0.25 times sales, Kroger stock trades at a discount compared to industry peers like Walmart Inc. (WMT) and Costco.

Stellar Q4 Performance and Positive Outlook

Following a remarkable Q4 earnings report, Kroger witnessed a 9.9% surge in share value as it announced robust financial results and optimistic future projections. The company’s Q4 sales of $37.1 billion, a 6.4% increase year-over-year, and a profit of $1.34 per share (excluding one-time items) surpassed market expectations.

Kroger’s strategic focus on digital sales growth, increased customer engagement, and enhanced operational efficiencies fueled this financial success.

The company anticipates a promising 2024, relying on rising grocery demand, efficient cost management, and the strength of its private-label brands. By introducing new products and engaging in promotional pricing strategies, Kroger aims to bolster its market standing and drive consumer demand.

Forecasts for fiscal 2024 predict Kroger’s identical sales (excl. fuel) to rise between 0.25% and 1.75%, with an adjusted EPS range of $4.30 to $4.50. The company is set to release its Q1 earnings on Thursday, June 20, with analysts eyeing a profit of $1.33 per share.

Kroger’s Entrance into the GLP-1 Weight-Loss Market

Kroger’s innovative foray into weight loss solutions entails transforming its Little Clinics into wellness hubs, offering a unique combination of medical guidance, weight management education, and cutting-edge GLP-1 treatments. The company plans to make popular GLP-1 drugs like Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound accessible to patients starting at $99 per visit.

With around 226 clinics spread across nine states, Kroger Health’s The Little Clinic unit will spearhead this initiative, both in-person and through telehealth consultations, marking a bold step in merging retail and healthcare services.

Analyst Insights and Future Projections

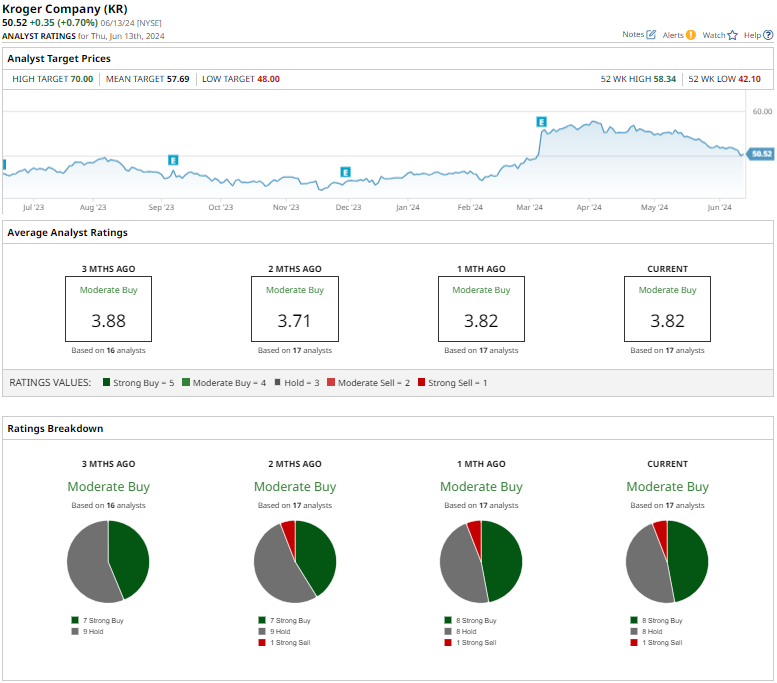

Market analysts foresee Kroger’s earnings per share to reach $4.43 in fiscal 2024, with further growth to $4.64 in fiscal 2025. The stock maintains a consensus “Moderate Buy” rating, with a spectrum of analyst recommendations ranging from “Strong Buy” to “Strong Sell.” The average price target of $57.69 implies a potential upside of 14.2%.

While Kroger showcases promising growth prospects, the highest price target of $70 suggests a substantial 38.6% surge in stock value from current levels.