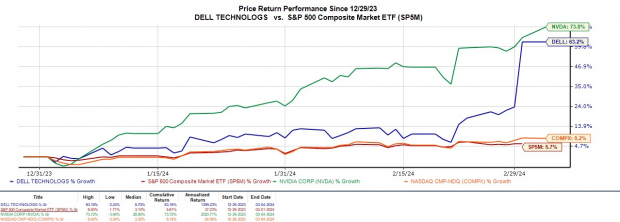

Dell Technologies DELL stock has surged by a remarkable 32% post its robust Q4 results last Thursday, highlighting the IT solutions leader’s continued dominance in the realm of artificial intelligence. This upward trajectory coincides with Dell leveraging Nvidia’s NVDA AI-powered GPUs for its servers, aligning itself with the chip giant’s remarkable success.

Corresponding with escalating demand and heightened interest in enterprise AI, Dell’s stock has catapulted by a staggering 63% year to date, closely mirroring Nvidia’s 74% surge. As the dust settles, let’s scrutinize Dell’s Q4 performance, future outlook, and valuation to determine if now is the opportune moment to delve into its stock post the significant post-earnings rally.

Image Source: Zacks Investment Research

Prominent Q4 Performance

Dell’s Q4 earnings of $2.20 per share significantly surpassed the Zacks Consensus of $1.73 a share by 27%. Notably, Q4 EPS surged by 22% from the previous year, ascending from $1.80 per share. Despite Q4 sales of $22.31 billion slightly missing estimates by approximately 1%, marking a decline from $25.03 billion in the corresponding quarter, Dell has now surpassed earning projections for eight consecutive quarters, registering an average earnings surprise of 39.9% in its last four quarterly disclosures.

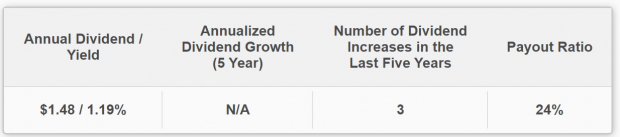

Image Source: Zacks Investment Research

Dell’s total sales for fiscal 2024 amounted to $88.43 billion, reflecting a 14% dip from FY23. Non-GAAP operating income stood at $7.7 billion, with earnings per share at $7.13, indicating a decline of 11% and 6%, respectively. Nonetheless, Dell buoyed the earnings beat with optimistic projections for FY25, and the announcement of a 20% surge in its annual dividend to $1.78 per share, compared to the previous year’s payout of $1.48 per share.

CEO Jeff Clarke highlighted a robust demand for the company’s AI-optimized servers, with orders soaring by nearly 40% sequentially, and backlog almost doubling, closing the fiscal year at $2.9 billion.

Looking at the options trading landscape today, there are notable movements within the S&P 500 index. Particularly, Tesla Inc (Symbol: TSLA) is in the spotlight, with a robust total volume of 1.2 million contracts traded so far. This amount is equivalent to around 115.7 million underlying shares. The trading volume seen today is a remarkable 162.1% of TSLA's average daily volume over the past month, standing at 71.4 million shares. Of particular interest is the high volume observed for the $220 strike call option expiring on September 06, 2024, with 82,024 contracts traded, reflecting approximately 8.2 million shares of TSLA. Visualize TSLA's last twelve-month trading history below, with the $220 strike depicted in orange:

Boeing Co. (Symbol: BA) also experienced significant options trading activity today, with a volume of 73,301 contracts, translating to around 7.3 million underlying shares. This volume represents approximately 131.4% of BA's average daily trading volume for the last month, standing at 5.6 million shares. High volume was noted for the $165 strike call option expiring on September 06, 2024, with 4,727 contracts traded, reflecting about 472,700 underlying shares of BA. The chart below illustrates BA's trailing twelve-month trading history, with the $165 strike highlighted:

Apple Inc (Symbol: AAPL) is another player with notable options volume, boasting 581,260 contracts traded today. These contracts represent approximately 58.1 million underlying shares, amounting to a substantial 131.3% of AAPL's average daily trading volume over the past month, which is 44.3 million shares. Noteworthy activity was seen for the $225 strike call option expiring on September 06, 2024, with 31,798 contracts traded so far, representing roughly 3.2 million underlying shares of AAPL. The image below showcases AAPL's trading history, with the $225 strike highlighted:

For more detailed information on available expirations for TSLA, BA, or AAPL options, interested investors can visit StockOptionsChannel.com.

Explore More: Historical Stock Prices of PYPLV CPHC Shares Outstanding History Exploring ZTS Market Cap History

Image Source: Zacks Investment Research

Positive Forecast & Perspective

The first quarter is expected to see Dell’s revenue ranging between $21 billion to $22 billion, with a midpoint of $21.5 billion, reflecting a 3% uptick. Looking towards the full year of fiscal 2025, Dell anticipates revenue in the bracket of $91 billion to $95 billion, centered around $93 billion, signifying a 5% growth trajectory. Dell’s guidance aligns closely with the current Zacks Consensus of $93.76 billion for FY25, pointing towards a 6% revenue growth, while FY26 showcases an additional 1% sales escalation.

Based on Zacks estimates, Dell’s annual earnings display a projected stability for FY25, followed by a 17% surge in FY26 to $8.30 per share.

Image Source: Zacks Investment Research

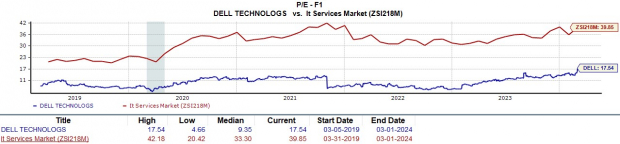

Supportive Valuation Indicators

Following the resounding post-earnings upsurge, it comes as no surprise that investor attention is turning towards evaluating Dell’s valuation. Encouragingly, Dell’s stock is currently trading at 17.5X forward earnings, positioning it below the S&P 500’s 21.5X multiple, and at a substantial discount compared to the Zacks Computers-IT Services Industry average of 39.8X.

Image Source: Zacks Investment Research

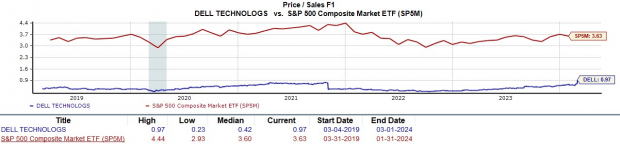

In terms of price-to-sales ratio, Dell’s stock maintains an appealing stance, boasting a P/S ratio of 0.97X forward sales. This level rests comfortably below the optimal threshold of less than 2X, with the S&P 500 at 3.6X and its industry average standing at 7.5X.

Image Source: Zacks Investment Research

Final Thought

Currently sporting a Zacks Rank #2 (Buy), the valuation of Dell suggests further upside post the positive Q4 outcomes. It hints towards the potential for more growth as the company capitalizes on its competitive advantage in generative AI solutions.