In the current state of market uncertainty, investors are on the lookout for promising investment opportunities amidst the volatility. Two such prospects that catch the eye are popular ride-sharing companies, namely Lyft (LYFT) and Uber Technologies (UBER).

The stocks of both Lyft and Uber have seen remarkable growth over the past year, with a staggering rise of over 20% each in 2024.

Let’s delve deeper into the potential short-term growth of Lyft and Uber shares and evaluate whether considering these stocks post a market correction could be a prudent move.

Image Source: Zacks Investment Research

Charting Growth Trajectories

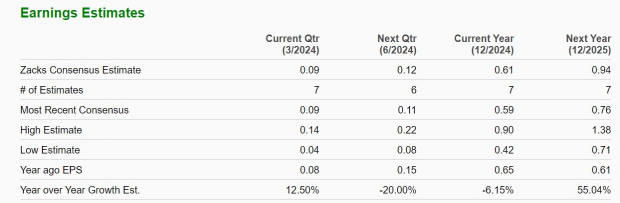

Focusing on its core ride-hailing services predominantly in the U.S. and Canada, Lyft is anticipated to witness a 16% sales expansion in fiscal 2024, with a further 13% surge expected in FY25, reaching a total of $5.81 billion. While the annual earnings projection for FY24 indicates a slight dip to $0.61 per share compared to last year’s $0.65, FY25 holds promise with an anticipated 55% hike to $0.94 per share.

Image Source: Zacks Investment Research

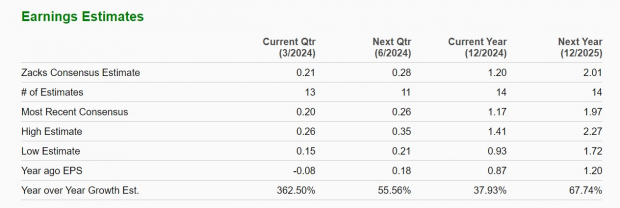

On the other hand, Uber has continued its global expansion, venturing into markets like Canada, Europe, Latin America, and the Middle East. Moreover, the company has expanded its offerings to include food delivery services, with sales projected to escalate by 16% in FY24 and expected to climb another 16% in FY25, reaching $50.49 billion.

What’s even more enticing is Uber’s prospective EPS growth, forecasted to leap by 38% in FY24 to $1.20 per share from $0.87 in 2023. The momentum is set to continue with a whopping 68% surge expected in the following year, taking it to $2.01 per share.

Image Source: Zacks Investment Research

Insight into Earnings Estimate Revisions

The stellar stock performance of both Lyft and Uber has been underpinned by their robust growth trends and their march towards profitability. However, when gauging the potential for further growth in a stock, positive earnings estimate revisions play a pivotal role, with Uber emerging as a standout performer in this domain.

Notably, the EPS estimates for Uber’s FY24 and FY25 have shown an upward trajectory over the past quarter, with a marginal uptick in the last 30 days.

Image Source: Zacks Investment Research

Meanwhile, Lyft’s EPS estimates for FY24 and FY25 have seen downward revisions of -3% and -11% over the last 60 days respectively.

Image Source: Zacks Investment Research

In Conclusion

Evaluating the substantial growth potential of Lyft and Uber’s stocks, it is evident that they could be attractive options for investors seeking to capitalize on market dips. Nevertheless, with Uber’s stock holding a Zacks Rank #1 (Strong Buy) and displaying favorable earnings estimate trends, it might present a more promising path for further upside, while Lyft’s shares are assigned a Zacks Rank #3 (Hold).

Analysis of Infrastructure Stock Boom in America

A significant initiative to revamp the deteriorating infrastructure in the U.S. is on the horizon. This bipartisan effort is not just essential but also inevitable, with trillions slated for investment and substantial fortunes waiting to be amassed.

The pertinent question remains—will you position yourself early in the right stocks to maximize their growth potential amidst this monumental transformation?

Zacks has unveiled a Special Report to guide you in this pursuit, and it’s currently available for free. Explore five distinguished companies poised to reap the most benefits from the colossal reconstruction and enhancement of roads, bridges, buildings, along with the revitalization of cargo transport and energy systems on an unprecedented scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>