The anticipation surrounding Netflix’s financial performance is palpable, especially since the streaming giant no longer gives subscriber growth guidance. With a staggering 260 million users globally as of the end of 2023, Netflix remains unrivaled in the streaming space.

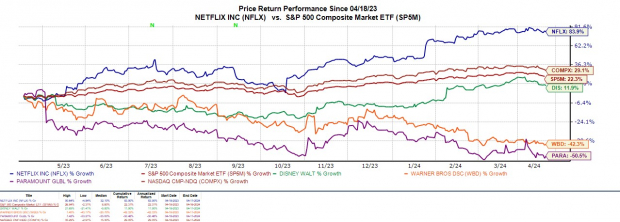

The market echoes this sentiment, propelling Netflix’s stock price 26% higher year-to-date, edging out Disney’s 25% increase and overshadowing the lackluster performances of competitors like Paramount Global (PARAA) and Warner Bros. Discovery (WBD).

As we gear up for Netflix’s Q1 earnings report after market close on Thursday, April 18th, investors are eager to evaluate if this is the opportune moment to buy Netflix shares.

Image Source: Zacks Investment Research

Peeking into Q1

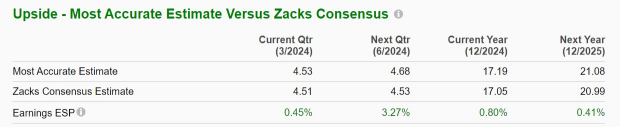

Forecasts from Zacks predict a 13% increase in Netflix’s Q1 sales to $9.26 billion. The consensus also anticipates a whopping 56% surge in Q1 earnings to $4.51 per share compared to $2.88 per share in the previous year.

Even more intriguing, the Zacks ESP (Expected Surprise Preidciation) indicates that Netflix might surpass bottom line expectations, with the Most Accurate Estimate pegging Q1 EPS at $4.53, slightly exceeding the Zacks Consensus.

Image Source: Zacks Investment Research

Surging Streaming Stats

Netflix’s affordability and ad-supported model have propelled its subscriber growth ahead of Disney Plus and other emerging platforms.

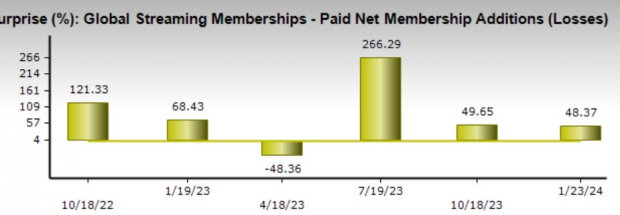

Zacks estimates suggest Netflix likely added 5.73 million global paid memberships in Q1, a remarkable 227% surge from the 1.75 million in Q1 2023. Notably, in Q4, Netflix surpassed expectations by adding 13.12 million paid subscribers, beating estimates by 48%.

Image Source: Shutterstock

Evaluating Netflix’s Valuation

Trading at 36.2X forward earnings, Netflix’s current valuation is well below its five-year high of 114.9X and slightly lower than the median of 49.7X. Projected annual earnings for fiscal 2024 indicate a substantial 42% increase to $17.05 per share from $12.03 per share the previous year. Additionally, estimates for FY25 EPS project a further 23% climb.

Image Source: Zacks Investment Research

Final Verdict

With Netflix’s stock soaring to over $600 per share year-to-date and holding a Zacks Rank #3 (Hold), the stage is set for a pivotal Q1 earnings report. Surpassing or matching expectations will be crucial for validating Netflix’s growth trajectory and attractiveness to investors.