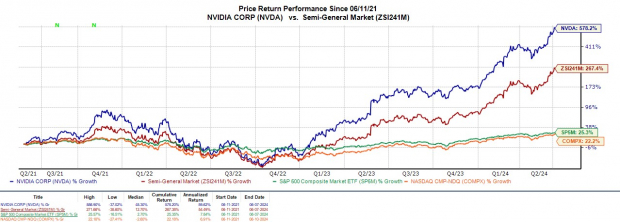

As Nvidia’s 10-1 stock split takes effect, the price of each share has reduced to approximately $120, inviting a wider pool of investors to partake. The chip giant’s stock had tripled in 2023 and doubled within the current year.

Stock splits, by essence, do not modify a company’s market value, yet the lowered share price beckons the question – is this an opportune moment to invest in NVDA following its prior trading at soaring all-time highs exceeding $1,000?

Position in Market

Nvidia’s position as a frontrunner in AI-powering semiconductor chips has recently elevated its market capitalization beyond Apple’s, reaching over $3 trillion, securing second place among U.S. companies, trailing behind Microsoft. This supremacy dwarfs that of other significant chip players like AMD and Intel, with market caps of $271 billion and $130 billion respectively.

Projected Growth Post-Split

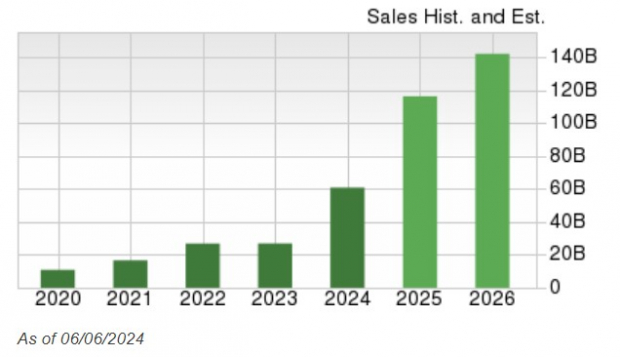

Nvidia’s substantial market cap and industry dominance present a strong case for potential stock investment. Notably, stock splits do not influence a company’s fundamental metrics or earnings; however, the earnings per share (EPS) dilute to accommodate the increased share count.

Nvidia’s annual earnings forecast for its fiscal year 2025 stands at $2.65 per share ($26.54 per share/10) with an anticipated 22% growth in EPS for FY26, projected at $3.25. Sales remain unaffected by stock splits, with a predicted 91% surge in FY25 to $116.4 billion from $60.92 billion in FY24. Furthermore, FY26 sales are slated to ascend by 22% to $142.29 billion.

Investment Outlook

Viewed optimistically, Nvidia’s stock split could be an entry point to align with the tech behemoth’s expansive growth at a more affordable rate. NVDA currently boasts a Zacks Rank #1 (Strong Buy).

The timing of the forward stock split aligns with the impending launch of Nvidia’s Blackwell series of GPUs, slated to debut later in the year. These chips are positioned to be the most potent AI chips on the market, surpassing the current H200 series and AMD’s MI300 series.