After surpassing quarterly earnings expectations, Nike (NKE) and Lululemon (LULU) observed a pullback in their stock prices today. Despite a strong earnings report, both companies presented softer guidance, leading to a market shake-up for these retail giants.

With Nike’s stock down 13% and Lululemon’s shares dropping 20% year to date, investors are faced with an opportunity – to buy the dip or exercise caution in the wake of these shifts in the market landscape.

Image Source: Zacks Investment Research

Favorable Quarterly Results

Nike’s fiscal third quarter results revealed a significant boost in earnings, exceeding expectations by 42%. Lululemon, on the other hand, reported a 20% increase in earnings from the comparative quarter. Despite these positive performances, market sentiment took a hit due to the conservative guidance provided by both companies.

Image Source: Zacks Investment Research

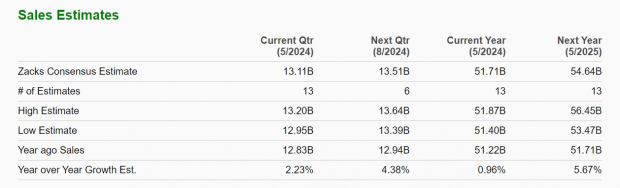

Weaker Sales Guidance

Nike and Lululemon’s cautious outlook on revenue growth fueled market unease. Nike anticipates a temporary decline in revenue in the first half of FY25, while Lululemon attributes lower sales guidance to subdued consumer demand. Despite posting commendable sales figures, future forecasts present challenges for these retail behemoths.

Image Source: Zacks Investment Research

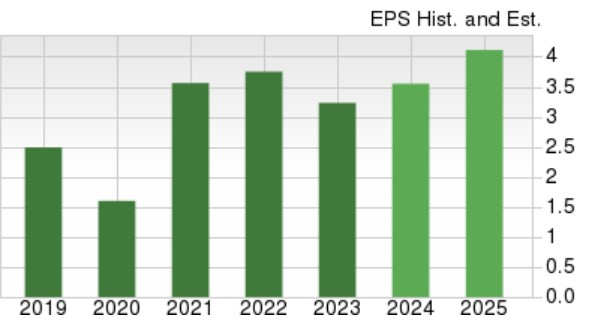

Earnings Outlook

Nike projects a steady rise in earnings for the coming years, with an estimated 16% jump expected for FY25. Lululemon’s earnings guidance features an upward trajectory as well, although below initial market expectations. Both companies continue to demonstrate resilience amidst changing market dynamics.

Image Source: Zacks Investment Research

Bottom Line

While short-term challenges persist for Nike and Lululemon, their long-term potential remains promising. Both stocks currently hold a Zacks Rank #3 (Hold), indicating a potential turnaround in the offing. Investors are urged to tread carefully in this volatile market, where opportunities lurk amid uncertainties for these retail stalwarts.