Alphabet GOOGL made waves in Friday’s trading session by exceeding first-quarter earnings projections and contributing to a robust market recovery yesterday.

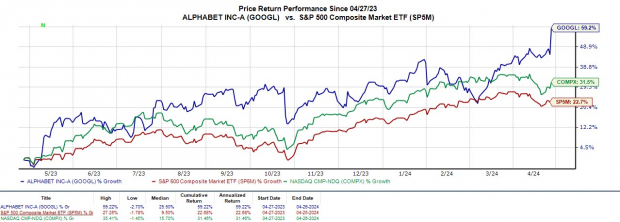

Alphabet shares surged over +10% today, fueled by the announcement of its inaugural dividend payment and a $70 billion stock repurchase authorization.

Let’s delve into Alphabet’s impressive Q1 results and assess whether now is an opportune moment to partake in the vigorous post-earnings rally, with GOOGL up over +20% year to date.

Image Source: Zacks Investment Research

Q1 Review

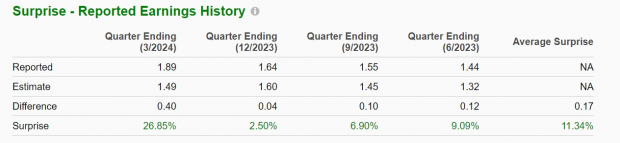

Alphabet’s Q1 earnings per share soared 61% to $1.89, surpassing the EPS of $1.17 from the same quarter last year. This robust performance exceeded the Zacks Consensus of $1.49 per share by 27%. Additionally, Q1 revenues of $67.59 billion marked a 16% increase from $58.06 billion in the previous year and exceeded estimates by 2%.

Image Source: Zacks Investment Research

The outstanding results were credited to strong performances in Google Search, Cloud services, and robust advertising growth on YouTube. Alphabet also emphasized its positioning for the next stage of artificial intelligence through its cutting-edge Gemini platform, offering generative AI features across various modalities including audio, video, and text code.

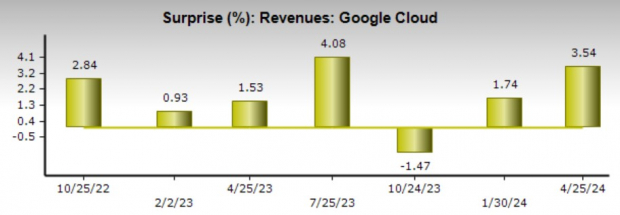

Notably, Google Cloud revenue surpassed expectations by 3%, registering a 28% year-over-year growth to $9.57 billion. Despite this, Alphabet remains in the third spot in the domestic cloud computing market, trailing behind Amazon’s AMZN AWS and Microsoft’s MSFT Azure.

Image Source: Zacks Investment Research

Market Cap & Dividend

Alphabet announced a quarterly dividend of $0.20 per share, with the first payout scheduled for June 17 to shareholders on record as of June 10. Following this news, Alphabet’s stock briefly hit a $2 trillion market cap for the first time since 2021, putting it behind only Apple AAPL and Microsoft in terms of market capitalization.

Image Source: Zacks Investment Research

Bottom Line

Alphabet’s Q1 report reaffirmed expectations of double-digit growth in both revenue and earnings for fiscal 2024, earning GOOGL a Zacks Rank #3 (Hold) for now. However, with a potential uptrend in earnings estimates in the near future, it wouldn’t be surprising to see a buy recommendation emerge in the upcoming weeks.