Walmart’s WMT stock is attracting attention as it prepares for a three-to-one stock split scheduled for Monday, February 26. Trading at $177 a share, the split is set to bring the opening price down to around $59. With over 400,000 associates involved in Walmart’s stock purchase plan, the company aims to enhance share affordability for retail investors, generating excitement among stakeholders. Let’s delve into Walmart’s recent price trends and determine if the upcoming stock split presents a buying opportunity post-Q4 earnings announcement.

Reviewing Stock Performance

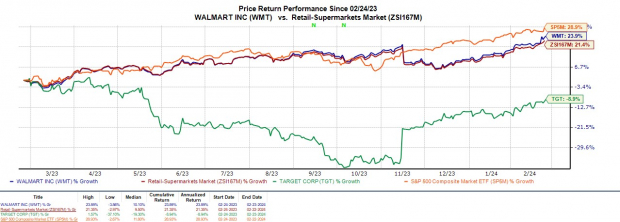

Walmart’s stock has surged by +12% year-to-date, surpassing the S&P 500’s +6% and outrunning its omnichannel rival Target’s TGT +7%. Over the last year, Walmart’s shares have soared by +24%, outperforming Target’s -9% and the Zacks Retail-Supermarkets’ +10%, albeit slightly trailing the benchmark figures.

Image Source: Zacks Investment Research

Q4 Earnings Reflect E-commerce Success

Highlighting its Q4 performance, Walmart’s earnings of $1.80 per share exceeded the Zacks Consensus of $1.65 by 9%. With a 5% increase in yearly earnings, Walmart achieved a 5% growth in Q4 sales to $173.38 billion, surpassing estimates by over 1%.

Image Source: Zacks Investment Research

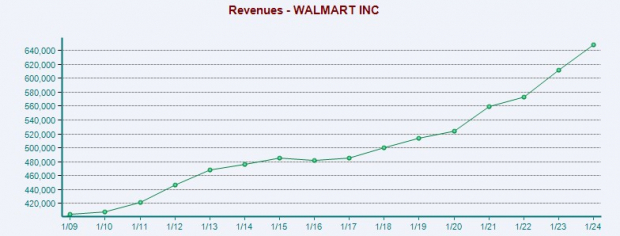

Driving its robust quarter was the 23% surge in e-commerce sales during Q4, propelling Walmart’s online sales for the year to over $100 billion. Overall, the company’s total sales in fiscal 2024 jumped by 6% to $648.1 billion, while annual earnings increased by 6% to $6.65 per share.

Image Source: Zacks Investment Research

EPS & Outlook Evaluation

Following the stock split, Walmart’s EPS will likely dilute due to the increased number of outstanding shares. However, it’s crucial to note that the overall earnings or net income of the company will remain unaffected, similar to how revenue or sales figures remain unaffected. Projections suggest a 3% increase in FY25 sales, with FY26 sales anticipated to rise by 4% to $698.5 billion. For FY25, annual earnings are forecasted to grow by 5% to $7.02 per share, translating to $2.34 post-split. In addition, a 9% EPS growth is expected in FY26.

Image Source: Zacks Investment Research

Final Thoughts

At present, Walmart’s stock holds a Zacks Rank #3 (Hold) following a strong start to the year. The surge in Walmart’s stock price is partly fueled by investors anticipating a pre-split price increase. Despite Walmart’s flourishing e-commerce sector and promising long-term prospects, it’s wise to remain cautious as a stock split does not guarantee an immediate uptick in share prices.