Amidst the tumultuous energy sector, opportunity lurks for investors eyeing undervalued companies on the brink of a potential resurgence.

One key indicator, the RSI (Relative Strength Index), serves as a valuable tool for investors, offering insights into a stock’s performance trends. When the RSI falls below 30, a stock enters oversold territory, indicating a possible buying opportunity. As history has shown, such moments often precede a stock’s ascent to new heights.

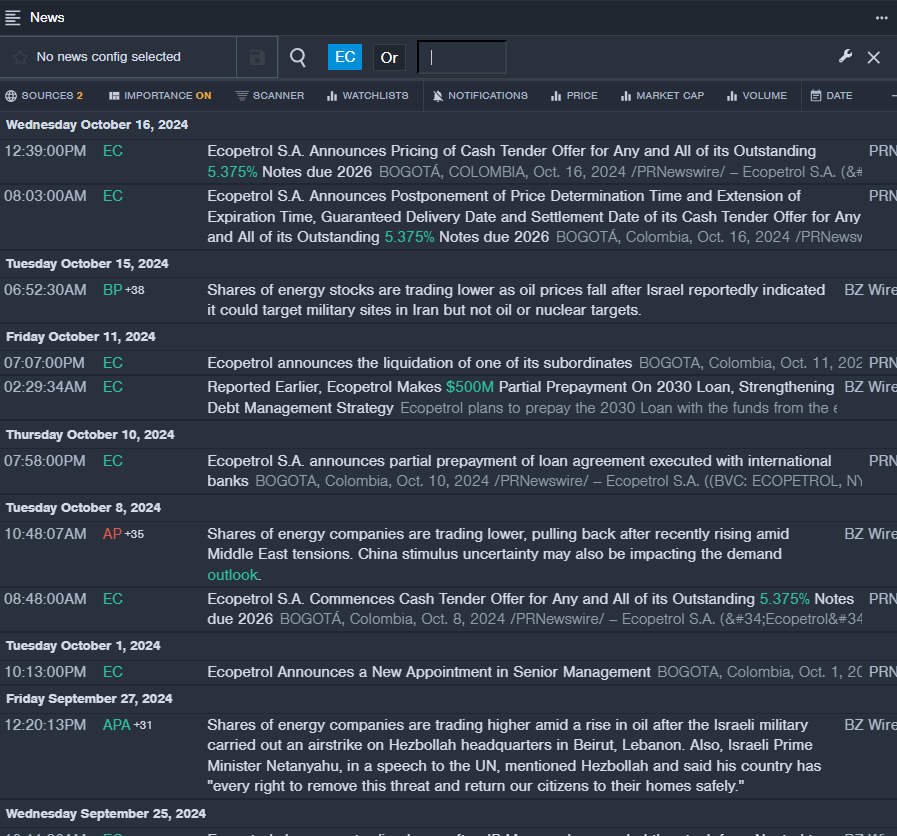

Ecopetrol SA: A Beacon of Potential

- Ecopetrol recently unveiled a cash tender offer for its 5.375% notes due 2026, a move to bolster its financial stance. Despite this positive development, the company’s stock spiraled downwards by nearly 11% over the past five days, hitting a 52-week low of $8.13.

- RSI Value: 26.20

- EC Price Action: Despite the recent decline, Ecopetrol shares closed at $8.15 on Thursday, showcasing resilience amidst market volatility.

Torm PLC: Navigating Choppy Waters

- Analyst Jonathan Chappell’s favorable outlook on Torm PLC instilled hope, with the company’s stock receiving an ‘Outperform’ rating alongside a revised price target. However, recent market turbulence caused Torm’s stock to plummet by approximately 17% in the past month, bottoming out at $26.10.

- RSI Value: 27.08

- TRMD Price Action: Despite the challenges, Torm’s resilience shone through as shares closed at $29.90 on Thursday, hinting at a potential rebound on the horizon.