Opportunity in the Storm

Editor’s Note: The article has been corrected to state that Dollar Tree’s 52-week low is $91.83.

Amidst the turbulence of the market, identifying oversold stocks in the consumer staples sector can be akin to finding a life raft in a stormy sea.

One key indicator, the Relative Strength Index (RSI), offers insight into potential buying opportunities. When RSI levels drop below 30, it signals that a stock may be oversold, presenting the chance to invest in undervalued companies.

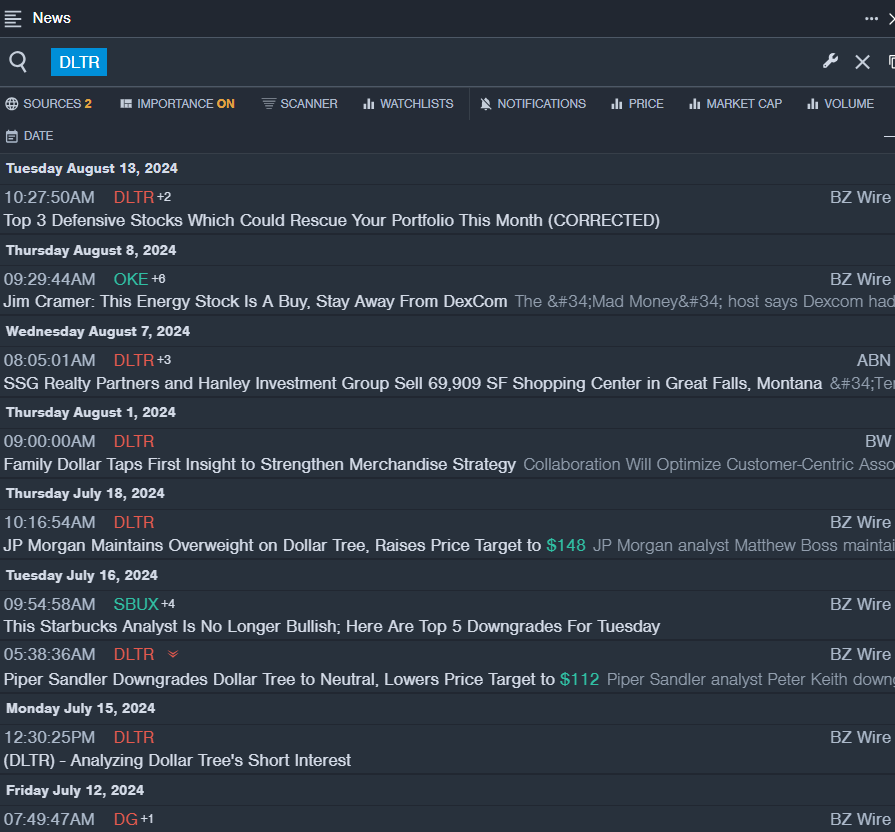

Dollar Tree Inc (DLTR)

- Recently, Dollar Tree saw a 10% drop in stock price, prompting JP Morgan’s analyst to raise its price target. With an RSI value of 27.53 and a 52-week low of $91.83, Dollar Tree presents a compelling option for value investors.

- DLTR Price Action: Dollar Tree’s shares closed at $93.90 on Monday.

Estee Lauder Companies Inc (EL)

- Estee Lauder’s stock witnessed a 15% decline, leading to a revised price target by Telsey Advisory Group. With an RSI value of 18.84 and a 52-week low of $86.05, Estee Lauder emerges as a potential value play in the consumer staples sector.

- EL Price Action: Estee Lauder closed at $86.20 on Monday.

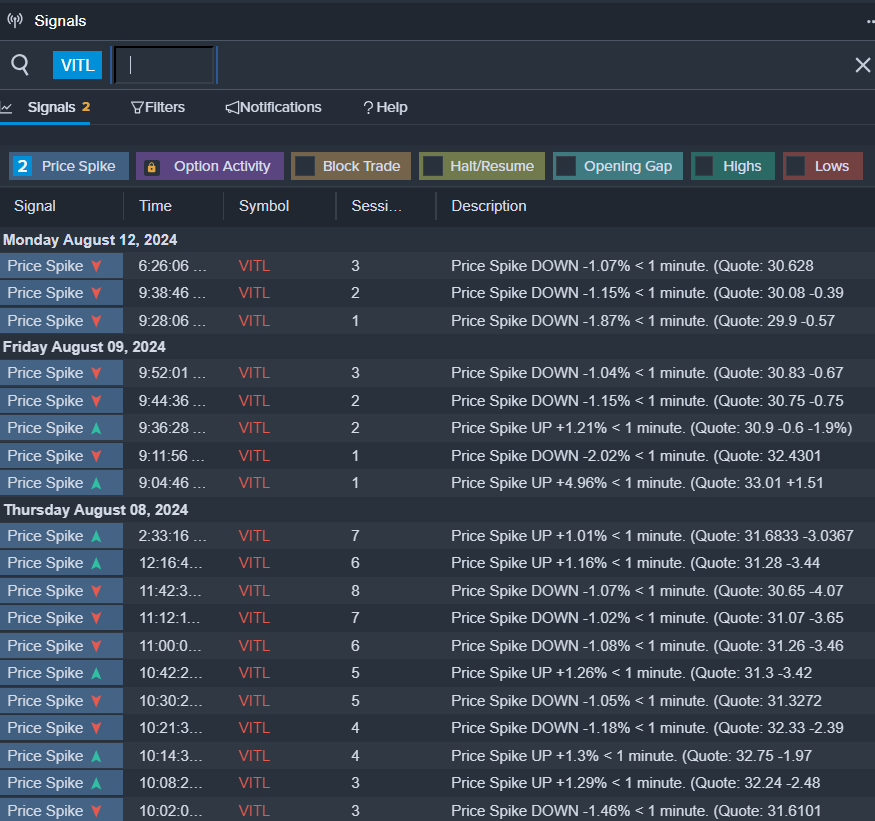

Vital Farms, Inc. (VITL)

- Vital Farms recently posted strong quarterly results, despite a 27% decline in its stock price. With an RSI value of 27.47 and a 52-week low of $10.30, Vital Farms’ performance presents an intriguing opportunity for savvy investors.

- VITL Price Action: Vital Farms closed at $30.96 on Monday.

Read Next: