The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

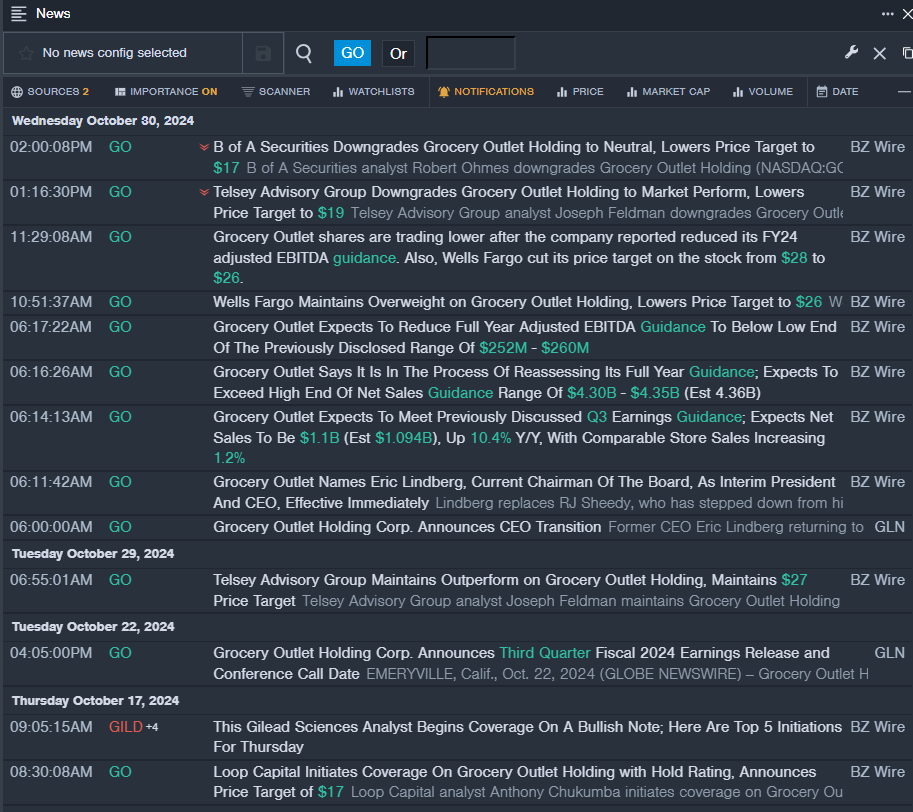

Grocery Outlet Holding Corp GO

- On Oct. 30, Grocery Outlet reduced its FY24 adjusted EBITDA guidance. The company’s stock fell around 21% over the past month and has a 52-week low of $13.60.

- RSI Value: 20.34

- GO Price Action: Shares of Grocery Outlet fell 16.3% to close at $13.90 on Wednesday.

- Benzinga Pro’s real-time newsfeed alerted to latest GO news.

Reynolds Consumer Products Inc REYN

- On Oct. 30, the company posted in-line earnings for the third quarter. “We are building on our leadership across household products and delivered another quarter of strong financial performance as a result,” said Lance Mitchell, President and Chief Executive Officer of Reynolds Consumer Products. “RCP’s business model is a competitive advantage and the trajectory of our commercial and financial trends is strong, making now the right time to implement our planned leadership transition.” The company’s stock fell around 11% over the past month and has a 52-week low of $25.08.

- RSI Value: 16.82

- REYN Price Action: Shares of Reynolds Consumer Products declined 6.2% to close at $27.69 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in REYN stock.

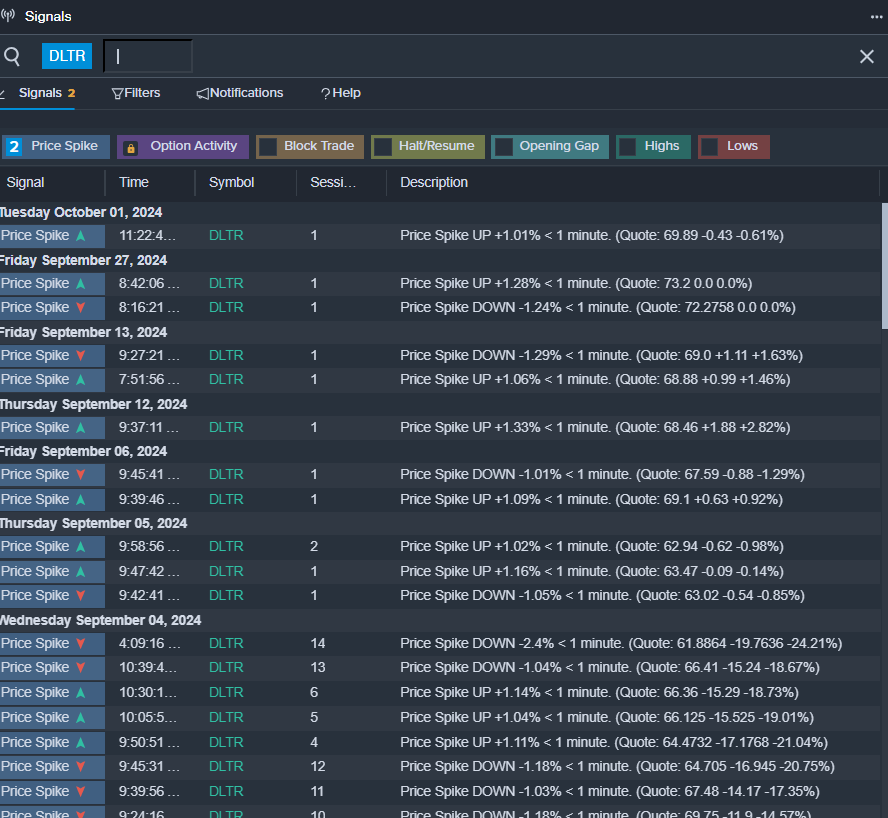

Dollar Tree Inc DLTR

- On Oct. 22, Evercore ISI Group analyst Greg Melich maintained Dollar Tree with an In-Line and lowered the price target from $105 to $100. The company’s stock fell around 10% over the past month and has a 52-week low of $60.82.

- RSI Value: 26.15

- DLTR Price Action: Shares of Dollar Tree fell 1.8% to close at $63.31 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in DLTR shares.

Read More:

Market News and Data brought to you by Benzinga APIs