A unique vista opens in the industrials sector, offering a potential delve into undervalued companies as the most oversold stocks beckon.

Traversing the markets, the Relative Strength Index (RSI) emerges as a valuable beacon. It meticulously contrasts a stock’s fortitude on bullish days against its mettle on bearish ones, hinting at the potential trajectory in the near term. Typically, an asset is stamped as oversold when the RSI dips below the 30-yard line, as per market insights.

Here, now, are the notable players laden with oversold metrics, their RSIs hovering near or beneath the crucial 30.

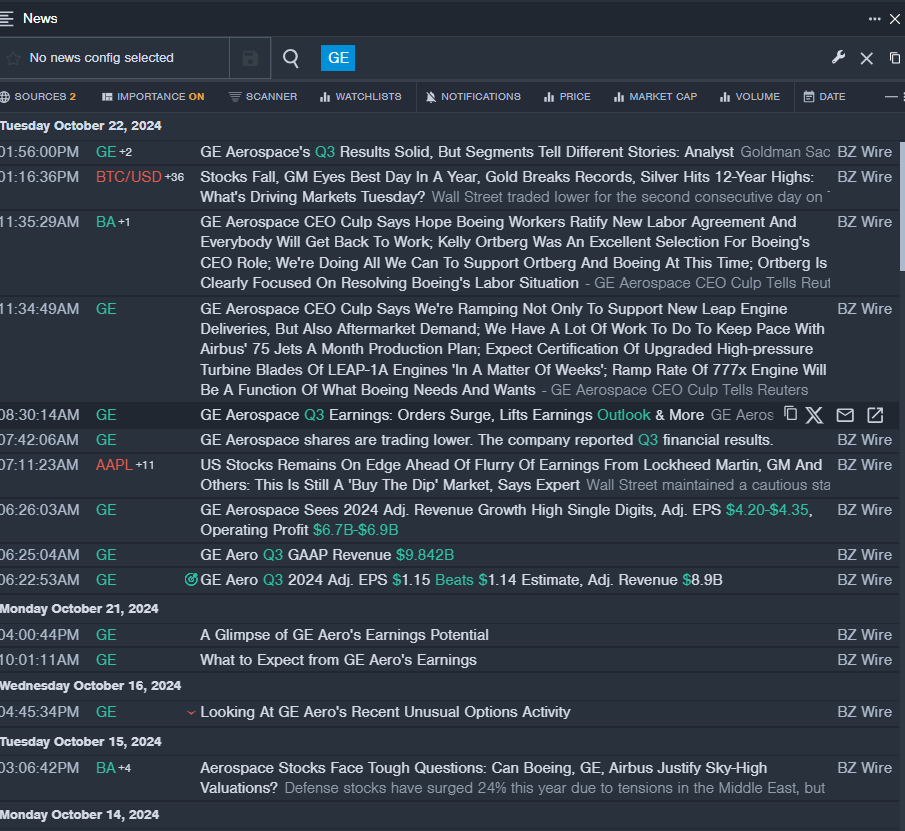

General Electric Co GE

- Not long ago, on Oct. 22, the behemoth reported a commendable surge in adjusted revenue, shining bright at a 6% year-over-year ascent to $8.943 billion, with GAAP revenue standing tall at $9.84 billion. The GE Aerospace domain painted a riveting narrative with orders soaring 28%, propelling earnings skyward by 25% and unleashing a torrent of free cash flow, largely incubated by services. Heartened by the robust results and optimistic about the fourth quarter, GE Aerospace Chairman and CEO H. Lawrence Culp, Jr. declared an uplift in annual earnings and cash guidance. However, the company’s shares weathered a tempestuous 7% descent over the past quintet of days, finding a resting place near a 52-week low of $84.32.

- RSI Value: 26.67

- GE Price Action: General Electric’s shares succumbed to a 9.1% plunge, settling at $176.66 as the closing curtains drew on Tuesday.

- The real-time newsfeed from Benzinga Pro stood poised, ready to alert investors to the latest winds wafting across GE.

Lockheed Martin Corp LMT

- In recent chronicles, Lockheed Martin unfurled a tapestry of mixed third-quarter achievements. The jewel in the crown was a modest uptick in net sales, sashaying 1.3% higher year-over-year to $17.104 billion. Yet, this figure missed the street’s whisper of $17.351 billion. Adjusted earnings per share, dancing at $6.84, trumpeted a rise from $6.77 in the antecedent year, eclipsing the anticipated $6.50. Bubbling with exuberance over their stellar year-to-date performance, Lockheed Martin’s Chairman, President, and CEO Jim Taiclet strutted with raised outlooks for the full fiscal symphony – more sales, peppier segment operating profit, jollier EPS, and freer cash flow. Despite the jubilant tone, the company’s shares stumbled through a 4% stumble during the past solar cycles, nestling near a 52-week low of $413.92.

- RSI Value: 29.00

- LMT Price Action: Lockheed Martin’s shares endured a 6.1% downturn, pulling up at $576.98 at the twilight on Tuesday.

- The adept charting tool within Benzinga Pro’s arsenal lent a helpful eye in discerning the tale of LMT shares.

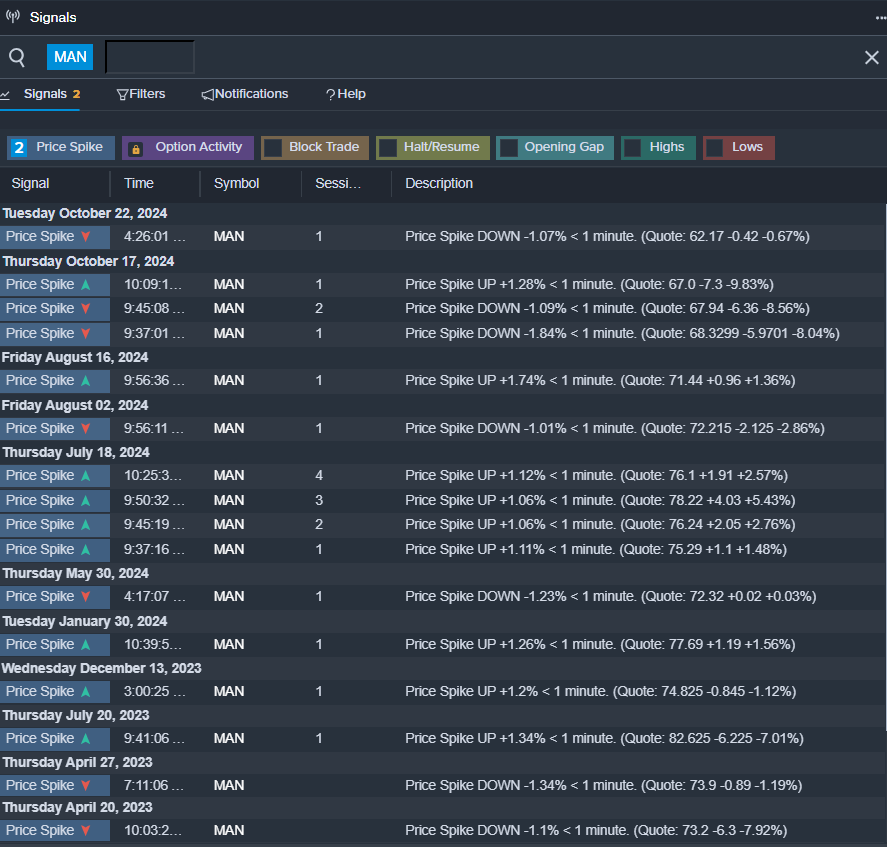

ManpowerGroup Inc MAN

- In a flashback to Oct. 17, ManpowerGroup unveiled a somber outlook for fourth-quarter earnings per share, a notch below the anticipations. The company’s equities stumbled through a 13% tumble over the past lunar phases, coming to a rickety position near a 52-week low of $61.53.

- RSI Value: 29.40

- MAN Price Action: ManpowerGroup swelled tentatively by 0.4%, tucking in at $62.84 at the round of Tuesday’s bell.

- The signals from Benzinga Pro fluttered a hopeful note of a looming potential upswing in the drama of MAN shares.

Read More:

Market News and Data brought to you by Benzinga APIs