Among the tumult of the industrial sector lies a unique opportunity to unearth undervalued gems within the realm of stocks.

One crucial metric, the Relative Strength Index (RSI), stands as a torchbearer in this journey. The RSI compares a stock’s strength on bullish versus bearish days, illuminating potential future performance. A stock is dubbed oversold when its RSI dips below 30, according to market insights.

Here are the top three underappreciated players in the industrial field, each with an RSI hovering near or below the critical 30 mark.

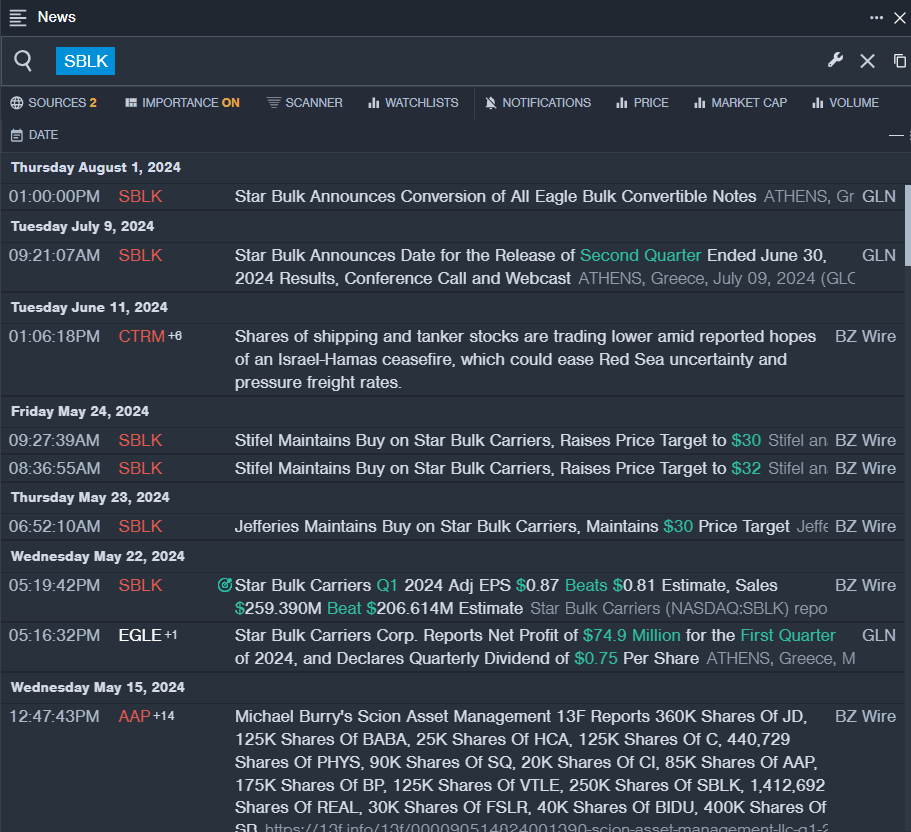

Journeying with Star Bulk Carriers Corp

- Star Bulk Carriers Corp is set to unveil its second-quarter results post-market close on Wednesday, August 7. The stock has weathered a recent storm, plummeting about 12% in a month, reaching its 52-week low at $16.86.

- RSI Value: 27.28

- Stock Performance: Star Bulk Carriers shares descended by 3.6%, settling at $21.74 at the end of trade on Thursday.

Embark on the voyage with Star Bulk Carriers, a ship navigating the turbulent seas of the industrial market.

The Odyssey of Symbotic Inc

- Symbotic Inc recently reported disappointing third-quarter earnings and provided a subdued fourth-quarter revenue outlook, below market expectations. The company’s stock plunged approximately 37% in just five days, hitting a low of $24.21 in its 52-week voyage.

- RSI Value: 26.59

- Stock Performance: Symbotic shares dipped by 8.2%, closing at $24.61 on Thursday.

Consider joining the quest with Symbotic Inc, a company navigating through the challenges of construction schedules and implementation costs.

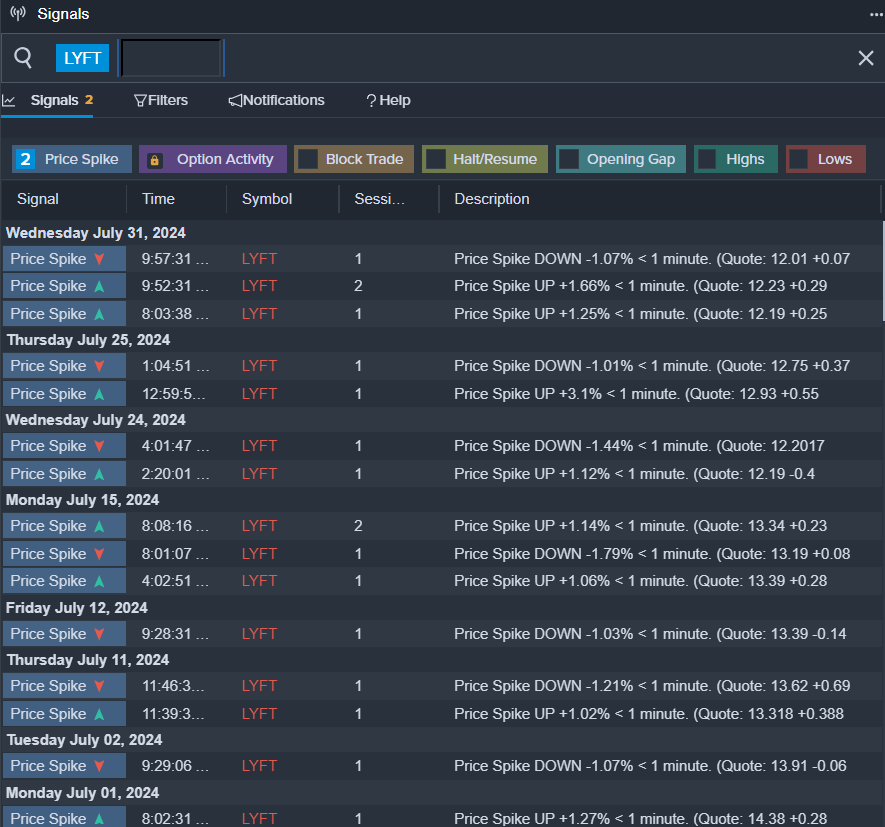

The Ride with LYFT Inc

- LYFT Inc recently announced the departure of President Kristin Sverchek, sending ripples through its stock performance. Shares fell by around 15% in a month, finding solace at a 52-week low of $8.85.

- RSI Value: 25.99

- Stock Performance: LYFT shares decreased by 5.2%, closing at $11.42 on Thursday.

Embark on the journey with LYFT Inc, a company navigating the twists and turns of market sentiment and internal transitions.