Investors seeking refuge amidst market uncertainty may find solace in the most oversold stocks within the consumer staples sector, offering a window to acquire undervalued assets.

One popular metric to gauge stock momentum is the Relative Strength Index (RSI), which juxtaposes a stock’s strength on upward and downward price movements. For traders, this metric paints a clearer picture of potential short-term performance. Typically, an RSI below 30 signals an oversold asset, as per market insights.

Let’s delve into the latest roster of significantly oversold players within this sector with RSIs hovering near or below 30.

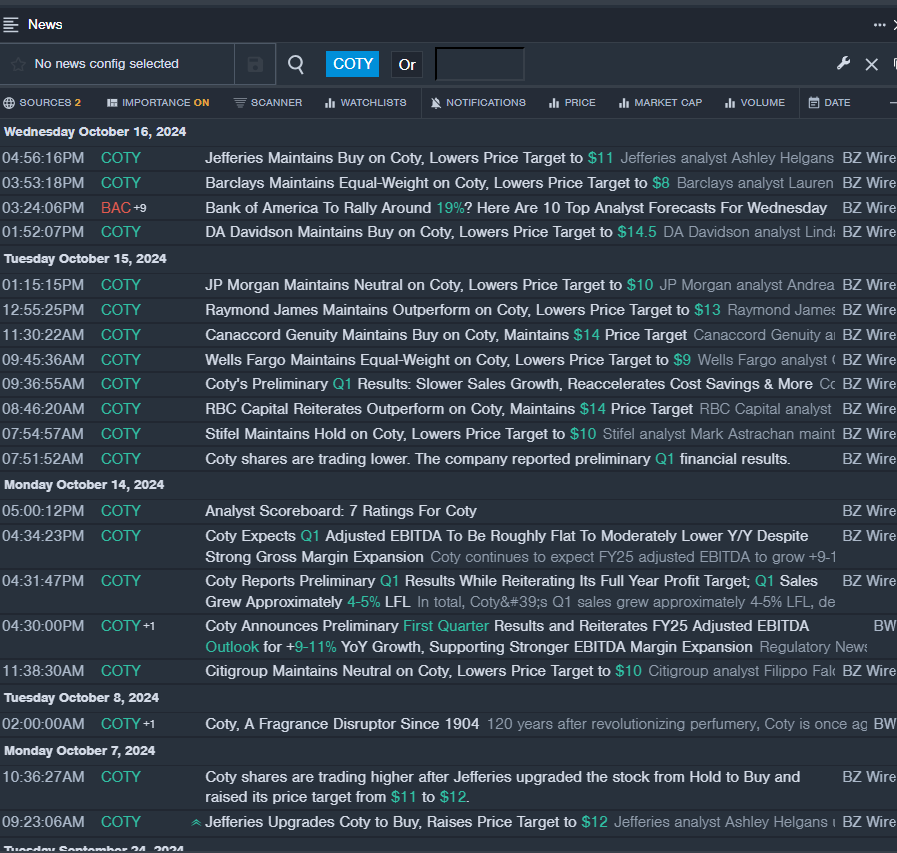

Discovering Coty Inc’s Potential COTY

- Coty Inc recently disclosed its preliminary first-quarter results, reaffirming its outlook for the fiscal year with a projected 9-11% growth in adjusted EBITDA. Despite these optimistic prospects, the company’s stock witnessed an approximate 11% decline over the last five days, hitting a 52-week low of $7.95.

- RSI Value: 29.19

- COTY Price Action: Coty’s shares concluded at $7.99 after a 2.3% drop on Wednesday.

- Benzinga Pro’s real-time updates offer keen insights into the latest developments surrounding Coty Inc.

Uncovering 22nd Century Group Inc’s Potential XXII

- 22nd Century Group Inc’s chairman and CEO, Lawrence Firestone, recently acquired 39,000 shares at an average price of $0.27 per share, according to an SEC filing. Nevertheless, the company’s stock faced a considerable plunge of around 43% in the past five trading days, touching a 52-week low of $0.10.

- RSI Value: 22.29

- XXII Price Action: The shares of 22nd Century Group Inc witnessed a 17.4% dip, settling at $0.11 by Wednesday’s close.

- Benzinga Pro’s analytical tools highlight the prevailing trends involving 22nd Century Group Inc stock.

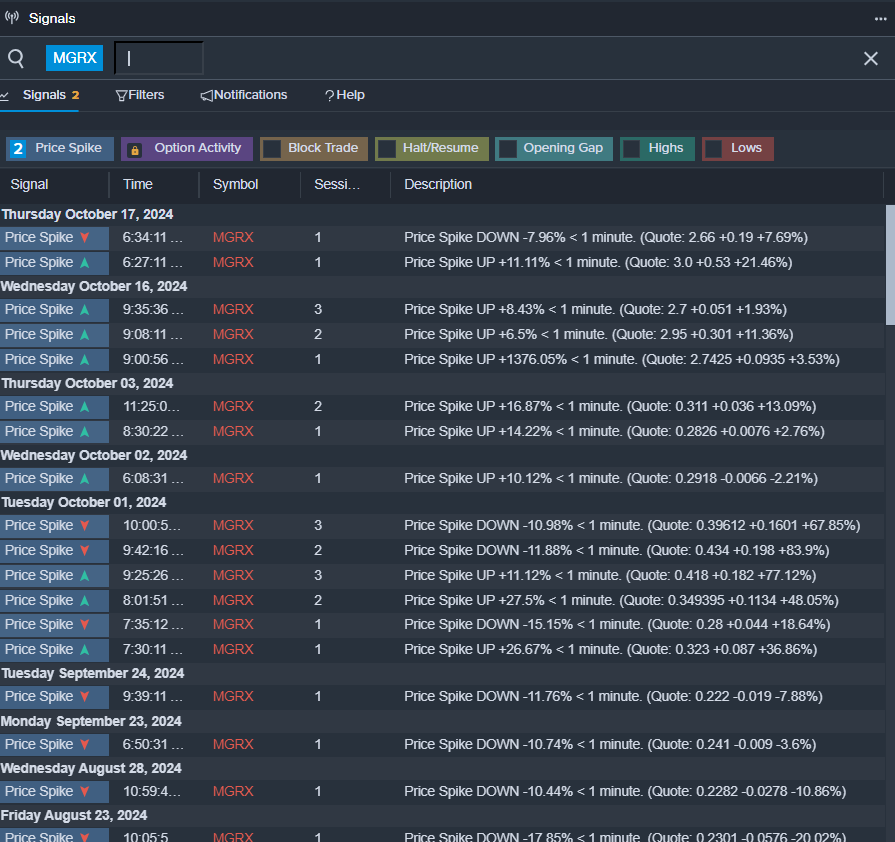

Exploring Mangoceuticals’ Prospects MGRX

- Despite initiating a 1-for-15 reverse stock split, Mangoceuticals observed a severe 21% decline in its shares over the past five days, touching a 52-week low of $2.14.

- RSI Value: 29.63

- MGRX Price Action: Mangoceuticals’ shares slumped by 6.8%, closing at $2.47 in Wednesday’s trading session.

- Using Benzinga Pro’s predictive signals, investors can anticipate potential breakouts in Mangoceuticals’ stock movement.

Read More:

Market News and Data brought to you by Benzinga APIs