Seeking out undervalued companies within the communication services sector may provide a golden opportunity for investors.

One measure investors can look to is the Relative Strength Index (RSI), a momentum indicator that compares a stock’s strength on up days to down days. When the RSI falls below 30, it signifies potential oversold conditions, indicating that the stock may be undervalued in the short term.

Here’s a rundown of three tech and telecom stocks showing promise with RSIs hovering near or below the crucial 30 mark:

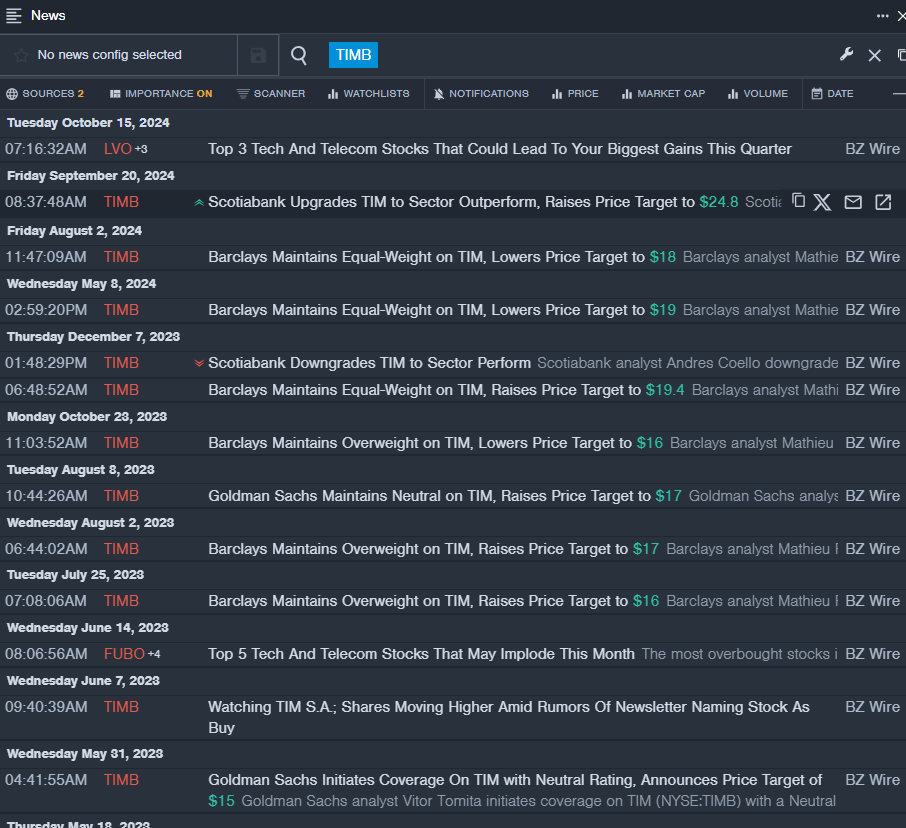

Tim SA TIMB

- Recently, Scotiabank analyst Andres Coello raised Tim SA’s rating from Sector Perform to Sector Outperform, setting a new price target of $24.8, up from $17.5. The stock, with a 52-week low of $13.84, experienced a 10% drop over the past month.

- RSI Value: 29.36

- Price Action: Tim SA’s shares closed at $15.21 on Monday, showing a slight increase of 0.1%.

- Real-time news from Benzinga Pro can keep you informed about the latest updates on Tim SA.

LiveOne Inc LVO

- LiveOne recently extended its partnership with Tesla (TSLA) till May 2026, emphasizing the potential for significant growth and revenue. The stock, with a 52-week low of $0.60, witnessed a notable decline of 55% over the past month.

- RSI Value: 23.74

- Price Action: LiveOne’s shares closed at $0.66 on Monday, marking a decrease of 7.4%.

- Benzinga Pro’s charting tool can assist in tracking trends in LiveOne Inc stock.

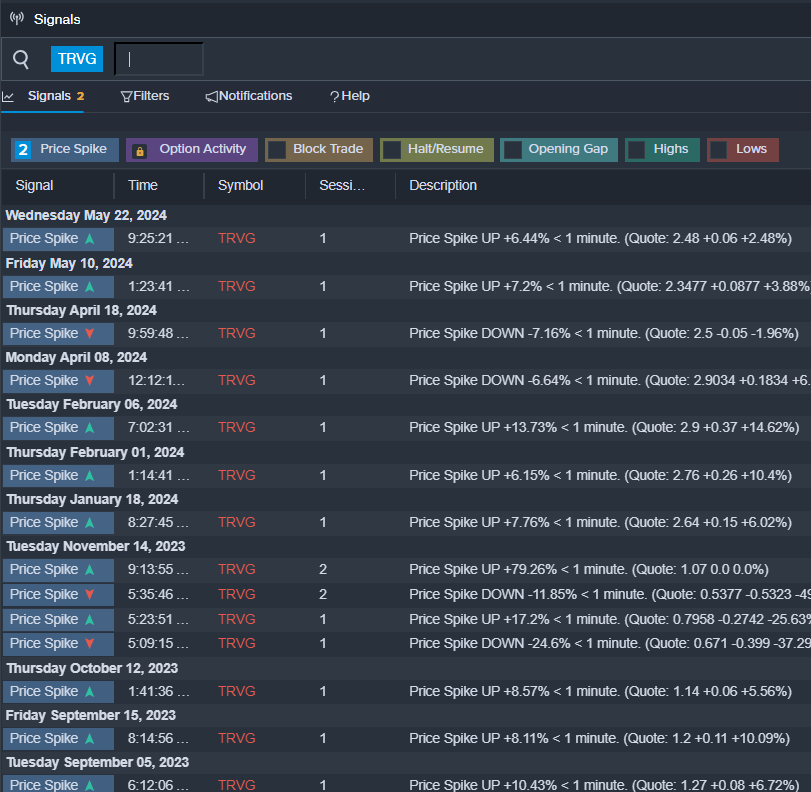

Trivago NV – ADR TRVG

- In July, Trivago reported a strong quarterly performance, surpassing expectations. Despite this, the stock, with a 52-week low of $1.61, saw a decline of around 7% in the past month.

- RSI Value: 27.82

- Price Action: Trivago’s shares closed at $1.69 on Monday, showing a modest decrease of 0.6%.

- Utilize Benzinga Pro’s signals feature to stay informed about potential shifts in Trivago NV – ADR shares.

Read More:

Market News and Data brought to you by Benzinga APIs