Opportunity Amidst Oversold Energy Stocks

The fluctuations in the energy sector have unveiled a promising window for investors to explore undervalued companies ripe for potential growth.

Understanding the Momentum Indicator

One tool contributing to this narrative is the Relative Strength Index (RSI), a pivotal gauge that offers insights into a stock’s potential performance. When the RSI dips below 30, it signals an oversold status, hinting at potential opportunities on the horizon.

Let’s delve into the profiles of four energy stocks exhibiting signs of being undervalued.

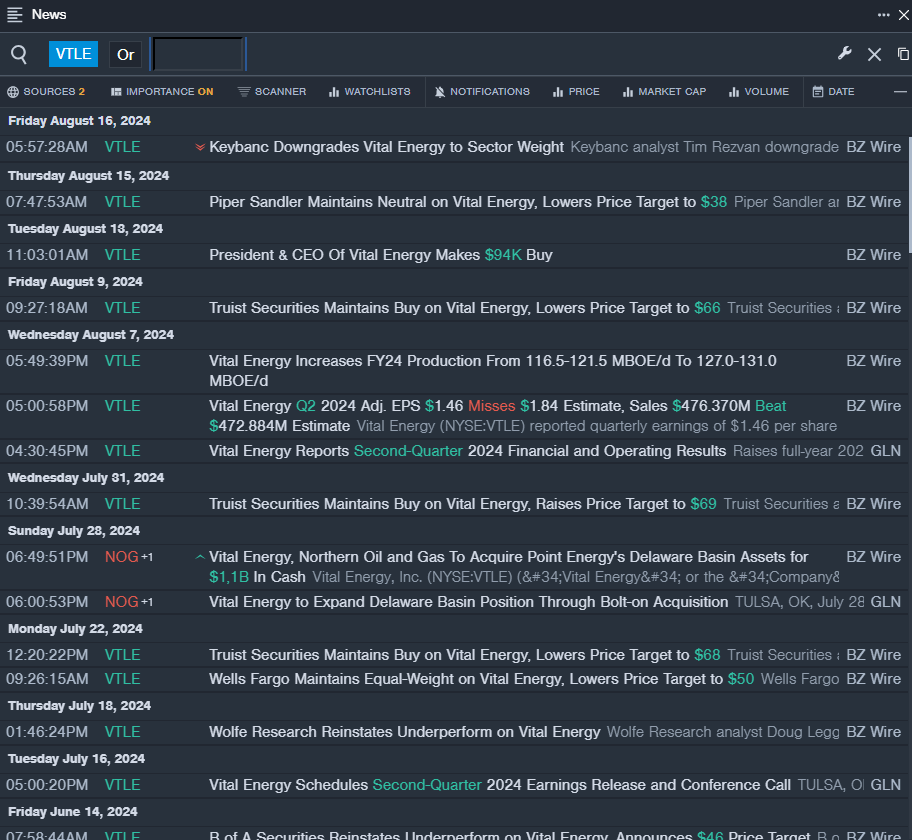

Vital Energy Inc – VTLE

- Despite posting downbeat quarterly earnings on Aug. 7, Vital Energy Inc remains optimistic about their operational strategies. The recent 16% decline in stock price and a 52-week low of $30.57 have positioned VTLE with an RSI value of 23.69.

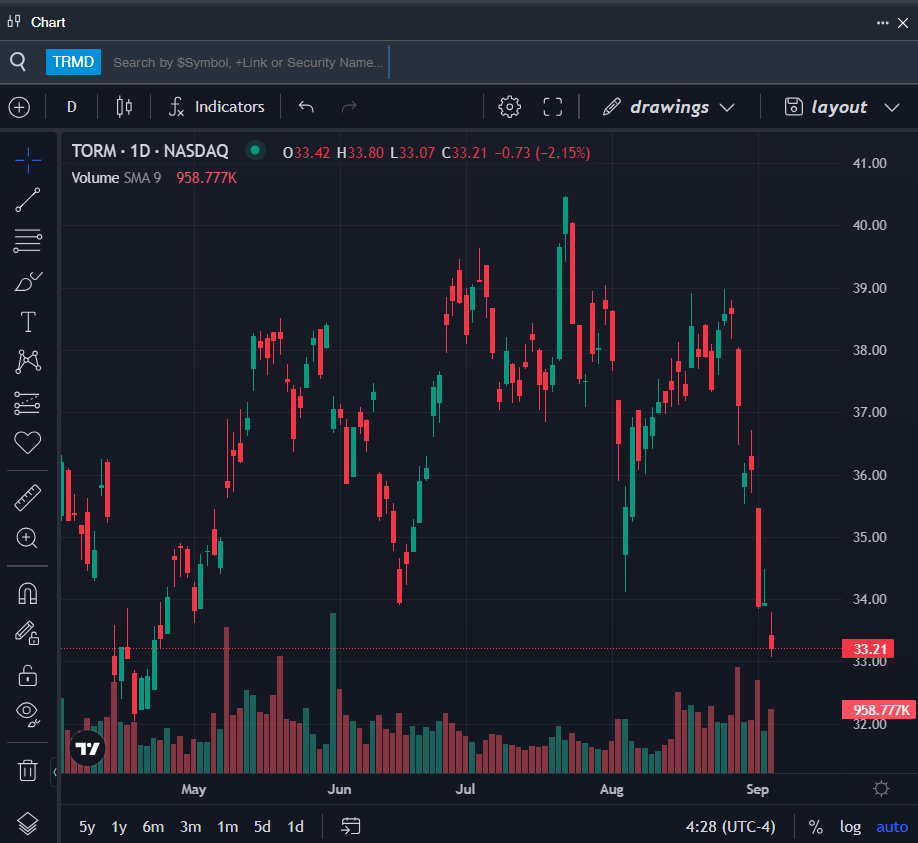

Torm PLC – TRMD

- Despite a recent 10% decline in stock price, Torm PLC has caught analyst attention, with its RSI value at 29.27. Evercore ISI Group’s positive outlook and a 52-week low of $24.12 indicate potential growth opportunities.

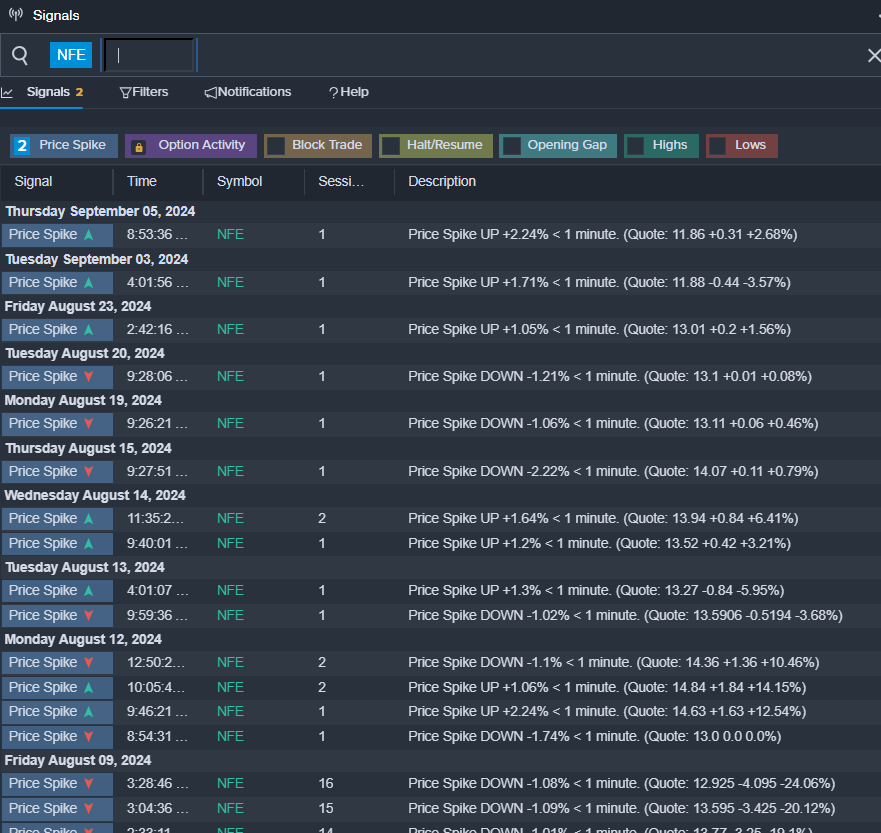

New Fortress Energy Inc – NFE

- New Fortress Energy Inc reported second-quarter results below expectations on Aug. 9, leading to a 29% stock price drop. With an RSI value of 29.64 and a 52-week low of $11.32, NFE displays characteristics of an oversold stock.

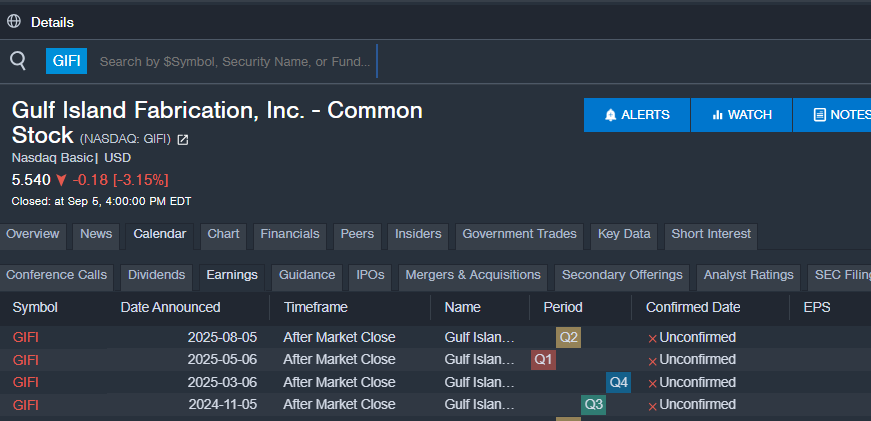

Gulf Island Fabrication, Inc. – GIFI

- Gulf Island Fabrication reported disappointing second-quarter results on Aug. 6, leading to a recent 7% stock price decline. With an RSI value of 29.73 and a 52-week low of $3.13, GIFI presents itself as a potential prospect for investment.

Investors are advised to consider these undervalued energy stocks for potential opportunities in the evolving market landscape.