Source: No named entity

John Newell of John Newell & Associates elaborates on why Giant Mining Corp. shines as an enticing prospect in the realm of junior mining.

Giant Mining Corp. BFGFF zeroes in on identifying, assessing, and procuring late-stage copper, silver, and gold assets amidst a landscape of rising global demand and dwindling supplies of precious metals. This uptick in demand is primarily spurred by initiatives like the U.S.’s Green New Deal and similar programs in other developed nations aimed at combating climate change. These efforts heavily lean on metals such as silver, gold, and notably copper for the production of electric vehicles (EVs), renewable energy sources, and the infrastructure necessitated for clean, affordable electricity.

As worldwide industries pivot towards a greener horizon, copper emerges as a vital piece in the battle against climate change. From EVs to AI hubs and renewable energy systems, copper’s significance cannot be overstated. In this light, Giant Mining Corp. unfolds as a captivating investment prospect within the junior mining arena. This article delves into why Giant Mining’s Majuba Hill Copper Property in Nevada stands as a potential game-changer in the copper supply chain.

The Majuba Hill Copper Property: A Pivotal Asset

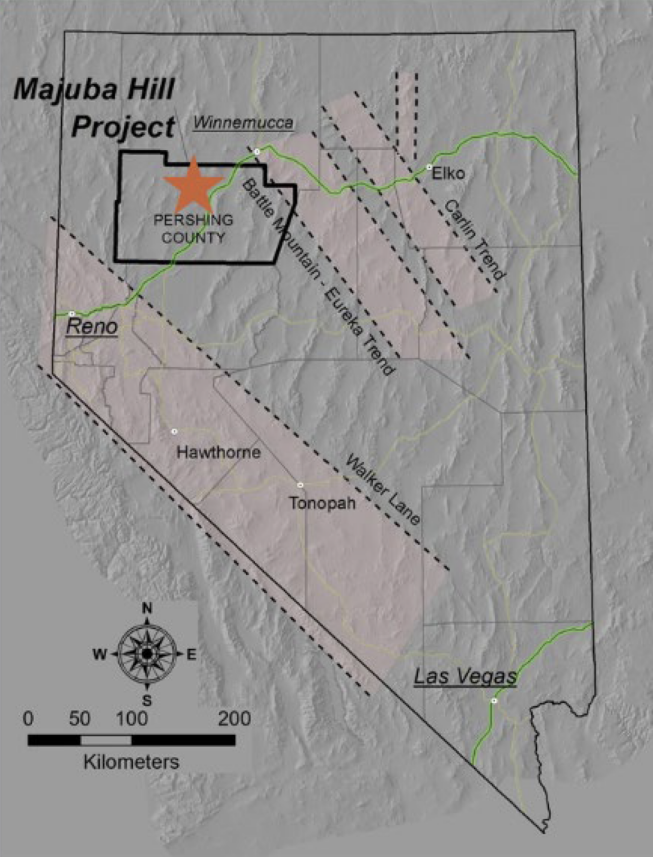

Situated in Nevada, a mining-friendly territory, the Majuba Hill property boasts a remarkable fusion of geology, infrastructure, and location. Nevada stands out as a top-tier mining jurisdiction renowned for its robust regulatory backing, extensive infrastructure, and availability of a skilled workforce.

Majuba Hill enjoys a strategic positioning — 113 kilometers (70 miles) from Winnemucca and 251 kilometers (156 miles) from Reno, making it both reachable and adequately isolated to sidestep clashes with residential expansion.

Key Highlights of the Majuba Hill Copper Property:

- Historical modest copper, silver, gold, and tin production traceable to the early 1900s.

- Contemporary exploration efforts, including over 104 drill holes and advanced geophysics, unearthing a notably larger copper, silver, and gold system.

- Promising drill outcomes, like 44.5 meters at 1.41% Cu and 113 meters at 0.45% Cu, validating the existence of economically viable mineralization.

- Potential for both oxide and sulfide copper systems, with oxide copper mineralization reaching depths of up to 490 meters (1,600 feet) beneath the surface and remaining open in all directions.

Copper’s Pivotal Position in the Global Economy

Copper doesn’t just hold the reins in today’s industries; it’s a linchpin for upcoming innovations.

The EV revolution, alone, is poised to propel an unparalleled demand for copper, with each EV calling for roughly 183 pounds of copper — a figure notably higher than traditional vehicles.

Copper also assumes a central role in renewable energy infrastructure, encompassing solar panels, wind turbines, and electric grids.

Presently valued at around $4.00 per pound, a dip from an earlier all-time peak this year.

Yet, copper is anticipated to witness continual price escalation as demand outstrips supply.

The International Copper Study Group foresees a 2% to 3% yearly growth in global copper demand through 2035.

Enterprises like Giant Mining Corp. hold a strategic vantage point to reap the benefits of the escalating need for fresh copper resources.

Proven Legacy and Upside Potential

Historical Yield at Majuba Hill:

- 2.8 million pounds of copper

- 184,000 ounces of silver

- 5,800 ounces of gold

- 21,000 pounds of tin

These bygone figures merely scratch the surface of Majuba Hill’s potency. Contemporary exploration hints at the property potentially harboring between 50 million to 100 million tonnes of copper, with gradings ranging from 0.15% to 0.30% Cu. Moreover, higher-grade sectors might encompass between 10 million to 20 million tonnes, boasting gradings as high as 0.80% Cu.

Between 2020 and 2022, Giant Mining executed several drill campaigns, concentrating on broadening known copper oxide and sulfide domains. These endeavors culminated in the identification of various high-grade copper locales, as well as gold and silver mineralization. Insights from over 16,000 meters of modern drilling have been amalgamated into 3D geological blueprints, laying the groundwork for an imminent resource assessment.

A Robust Team at the Helm: Giant Mining’s Management and Advisory Board

One standout facet of Giant Mining Corp. is its adept and seasoned management crew. Under the stewardship of CEO David Greenway, the enterprise garners backing from a burgeoning team of seasoned professionals, each with decades of experience in the mining and resource domains.

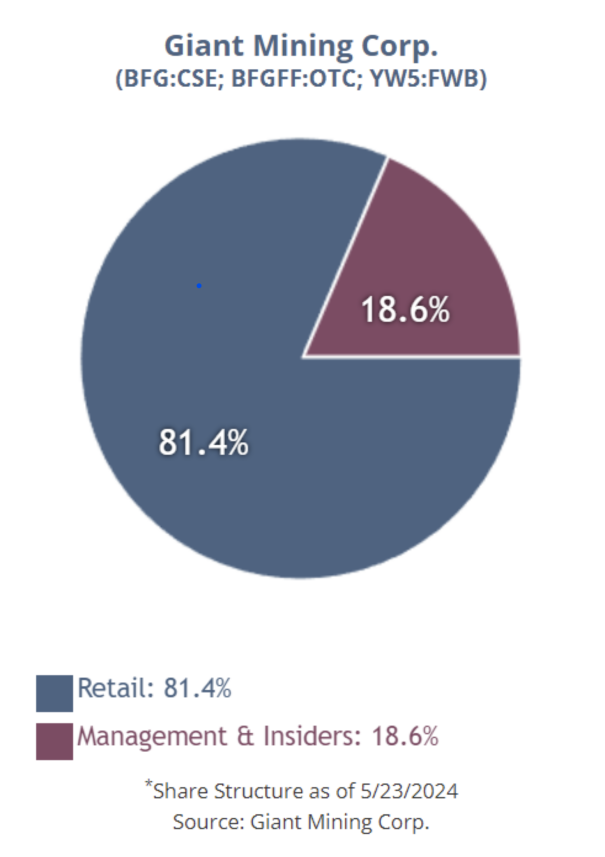

They also demonstrate shared values with existing shareholders, as management holds a substantial stake in the outstanding common shares, with ownership of roughly 20%, while the remainder is held by retail investors.

David Greenway, the CEO, boasts a proven track record in value creation and project advancement. His strategic acumen and business foresight have been pivotal in propelling the growth of several resource enterprises, positioning Giant Mining for prosperity.

- Natasha Sever, the CFO, brings over a decade of senior finance prowess across assorted industries, including mining, retail, and technology. Holding dual CPA licenses in Canada and Australia, Sever ensures the solidity of the company’s financial standing and strategic scheming.

- Joel Warawa, the VP of Corporate Communications, assumes a key role in public and investor relations. With over 20 years of experience in business expansion, mergers, and acquisitions, Warawa guarantees that Giant Mining’s narrative reaches key stakeholders and the broader investment community.

- Bradley J. Dixon, a Givens Pursley LLP partner, specializes in litigation within the natural resource sector, further fortifying the enterprise’s executive cadre.

- Larry Segerstrom, a veteran geologist with over 38 years of involvement in porphyry copper-gold projects, brings substantial technical expertise to the team.

Compact Share Configuration

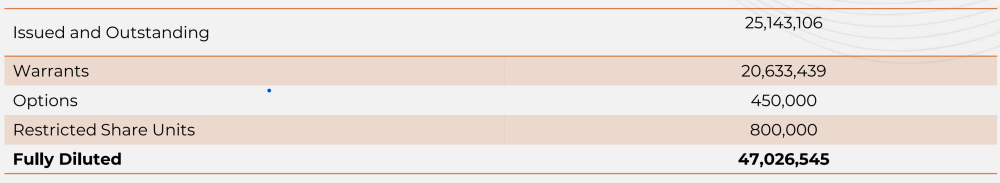

Giant Mining boasts a condensed share structure, with only 47 million shares at full dilution.

This compact setup, in conjunction with recent fundraising efforts, situates the company favorably for prospective share value appreciation as exploration outcomes are progressively unveiled throughout the property’s advancement.

Leo Hathaway Joins the Advisory Board

The advisory board recently saw the inclusion of Leo Hathaway, a geologist boasting extensive experience in the exploration and mining sectors. Hathaway has held senior positions at Lumina Gold Corp and Lumina Copper Corp, and his involvement in some of the premier copper discoveries in South America positions him as a valued asset for Giant Mining’s exploratory strategy at Majuba Hill.

Hathaway commented, “Majuba Hill represents…

Giant Mining Corp.: Unearthing the Copper Treasure Trove

The Exciting Potential of Majuba Hill

With a near-surface leachable copper target and multiple alluring primary copper prospects at various depths, Giant Mining Corp. has its eyes set on unlocking the full potential of Majuba Hill. The company’s eagerness is palpable, evident in their commitment to work diligently with a dedicated team.

Anticipated Milestones

Acting swiftly, Giant Mining Corp. has already set the wheels in motion for its 2024 diamond core drilling initiative and is on track to finalize an NI 43-101 resource estimate. This significant achievement could transition Majuba Hill from mere exploration to robust development, possibly piquing the interest of larger mining entities.

Furthermore, the ongoing Whittle Pit modeling process holds promise as it scrutinizes the deposit’s economic viability through a simulation of diverse mining scenarios, refining the project’s financial feasibility.

The Potential Game-Changer: Majuba Hill

“The project’s strategic location, favorable regulatory environment, and potential processing methods bode well if substantial copper quantities and associated elements are validated to meet Mineral Resource classification standards. Currently, an estimated copper Exploration Target ranges between 50 million tonnes and 100 million tonnes, showcasing grades varying from 0.15% Cu to 0.30% Cu.”

Benefiting from Nevada’s rich mining heritage and robust infrastructure, Majuba Hill enjoys a supportive backdrop for Giant Mining Corp.’s endeavors. The presence of renowned mining operations and essential infrastructure in the state sets a solid foundation for large-scale projects.

Key advantages of Majuba Hill include:

- Year-round road access maintained by Pershing County

- Close proximity to mining service hubs like Winnemucca and Reno, providing access to skilled professionals and equipment

- Convenient access to utilities such as power, water, and transportation, with links to the Union Pacific railway and major highways

Analyzing the Technical Outlook

Reflecting on the stock performance of Giant Mining Corp., it has navigated a steady trading range over the past year. Notably, in April, a market anomaly led to a brief downturn followed by a quick recovery, forming an “island reversal” pattern. A similar situation might be unfolding presently, with recent share fluctuations lacking substantial fundamental triggers.

Based on this analysis, experts view the current share value as opportune, especially at the lower end of the trading spectrum, warranting a Buy recommendation as a prudent contrarian investment.

The Future Beckons: A Compelling Investment Opportunity

Positioned advantageously in Nevada with solid infrastructure, promising geological prospects, and the potential for substantial copper output, Giant Mining Corp. emerges as an enticing prospect in the junior mining domain. The systematic exploration of Majuba Hill holds the key to unveiling a top-tier copper resource, catering to the escalating demand for copper fueled by the global economy’s shift towards electrification.

For investors eyeing exposure to copper within a stable and mining-friendly jurisdiction, Giant Mining Corp. presents a compelling proposition with significant upside possibilities. Given the recent decline in share value, the company stands out as an attractive avenue for exploration in the copper sector.

Conclusively, Giant Mining Corp. warrants a Buy recommendation, closing trading at CA$0.1950, US$0.1451 on September 6, 2024.