Deciphering Wall Street’s Perspective on Cava (CAVA)

When pondering the decision to invest in a stock, it’s common for investors to gravitate towards the guidance of analysts. The Wall Street heavyweights’ opinions on Cava Group (CAVA) are bound to capture attention. However, what weight should investors truly give to these recommendations?

Analyzing Brokerage Recommendations for Cava

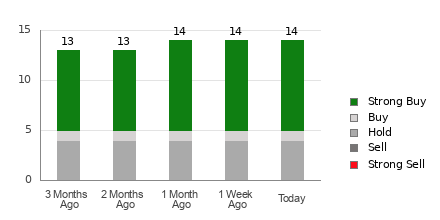

Cava currently boasts an average brokerage recommendation (ABR) of 1.61, indicating a stance between “Strong Buy” and “Buy.” This ABR stems from insights provided by 14 brokerage firms, with the majority recommending “Strong Buy” (64.3%) and “Buy” (7.1%).

Although the ABR leans towards a positive outlook for Cava, prudence is advised. Studies have shown that brokerage recommendations may not consistently lead investors to stocks with the best price appreciation potential due to a prevailing bias towards optimistic ratings.

Brokerage firms can be seen favoring “Strong Buy” ratings over “Strong Sell” by a ratio of 5 to 1, hinting at the underlying conflict of interest. Hence, relying solely on this information for investment decisions may not be advisable.

Comparing Zacks Rank to ABR

Enter the Zacks Rank, a reliable stock rating tool comprising five ranks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Unlike ABR, the Zacks Rank’s assessments are rooted in earnings estimate revisions, which have shown a strong correlation with near-term price movements.

Analysts’ biases are often tamed through the quantitative nature of the Zacks Rank, which swiftly reacts to changing earnings estimates, offering a more timely indicator of future price actions.

Analyzing Cava Group’s Investment Prospects

Recent earnings estimate revisions paint a rosy picture for Cava, with the Zacks Consensus Estimate for the current year climbing 2.9% to $0.25 in the past month. This surge, coupled with analysts’ optimistic revisions, has awarded Cava a Zacks Rank #2 (Buy), positioning it favorably for a potential upswing.

Given the scenario, the Buy-equivalent ABR for Cava could indeed furnish valuable guidance to prospective investors.

Highest Returns for Any Asset Class

It’s not even close. Despite ups and downs, Bitcoin has been more profitable for investors than any other decentralized, borderless form of money.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts another significant surge in months to come.

Hurry, Download Special Report – It’s FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CAVA Group, Inc. (CAVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.