When considering investment decisions, the echoes from Wall Street can be both enlightening and deceptive. Brokerage recommendations often hold sway over market sentiments, affecting stock prices. But should investors unquestioningly follow these threads spun by sell-side analysts?

Let’s delve into the intricate maze of Wall Street verdicts on CrowdStrike Holdings CRWD, exploring the reliability of brokerage recommendations in deciphering investment opportunities.

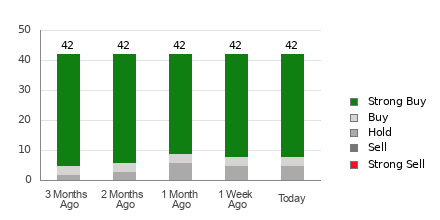

CrowdStrike currently basks in an average brokerage recommendation of 1.31, nestling between the realms of Strong Buy and Buy, as articulated by 42 brokerage entities. Within this array, an overwhelming 81% chant the Strong Buy hymn, while a modest 7.1% advocate for Buy.

The Mercurial Winds of Brokerage Recommendations for CRWD

A stoic ABR beckons investors towards CrowdStrike, yet relying solely on these whispers of Wall Street may lead one astray. Historical data underscores a lackluster performance of brokerage recommendations in steering investors towards stocks with maximum growth potential.

Why this muted credibility? The innate bias of brokerage firms towards stocks they cover orchestrates a symphony of positivity, with a ratio of five “Strong Buys” to every “Strong Sell.” This discord between institutional interests and retail investors offers dim illumination on a stock’s trajectory. Prudence dictates endorsing personal analysis or supplementing insights with robust predictive tools for prudent investment outcomes.

Zacks Rank, a revered stock rating compass with a proven track record, dons the mantle of forecasting stock movements via a nuanced lens. Aligning the ABR with Zacks Rank emerges as a beacon for astute investment choices, steering clear of the murky realm of whimsical brokerage proclamations.

ABR: Unraveling the Enigma

Beyond the veil of ABR, a stark disparity unveils the contrasting nature of Zacks Rank, underlining a unique method in the financial cacophony. While ABR clasps brokerage sentiments, often swaying towards decimal serenades, Zacks Rank strides on precise numerical footprints, powered by the pulse of earnings estimate revisions.

Brokerage analysts, overshadowed by optimism, pave a treacherous trail with recommendations misaligned with research depths, while Zacks Rank leverages earnings estimates as the North Star. Stock trajectories intimately intertwine with earnings forecasts, painting a somber contrast against the clamor of speculative anomalies.

In the realm of timeliness, ABR succumbs to the withering winds of outdated wisdom, while Zacks Rank, fueled by the pulsating rhythm of earnings estimate variances, dances exquisitely to forecast market metamorphoses.

Unveiling the Veil: CRWD under the Spotlight

Embarking on the road of earnings estimate chronicles for CrowdStrike, a poignant saga unravels with the Zacks Consensus Estimate witnessing a 34.2% descent over the past lunar cycle to $3.70.

The resounding pessimism echoing through analyst corridors, echoed in veracious consensus revisions, paints a dreary forecast for the stock’s trajectory, heralding a Zacks Rank #4 (Sell) prophecy for CrowdStrike.

Thus, prudent investors may do well to view the Buy-infused ABR for CrowdStrike with a critical lens, delving into the maze of market intricacies for informed decision-making.