When pondering whether to make a move on a stock, investors often gravitate towards the snippets of wisdom provided by analysts. Media buzz around these brokerage-recommended gems might sway the market, but is it all it’s cracked up to be?

Before we delve into the credibility of these analyst nods and how to leverage them to your advantage, let’s peek into the realm of Newmont Corporation (NEM) and what the Wall Street wardens have to say about it.

Understanding Wall Street Recommendations for Newmont Corporation (NEM)

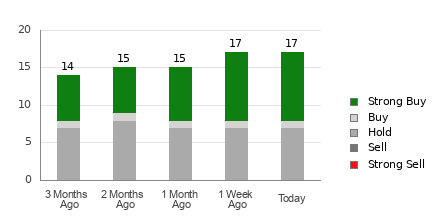

As it stands, Newmont boasts an Average Brokerage Recommendation (ABR) of 1.88, a numeric rendition on a scale of 1 to 5 (ranging from Strong Buy to Strong Sell). Derived from evaluations by 17 brokerage firms, this ABR nudges towards the territory nestled between Strong Buy and Buy.

Out of the 17 voices harmonizing in unison, nine hum the tune of Strong Buy, while a lone wolf reverberates the note of Buy. Strong Buy and Buy echo at frequencies of 52.9% and 5.9%, respectively, in the chorus of recommendations.

Deciphering the Trends in Brokerage Recommendations for NEM

Although the ABR melody might be chanting to buy Newmont, resting your investment call solely on this symphony might not be wise. Studies have hinted at the fickle nature of brokerage recommendations when it comes to spotting stocks with the brightest ascent on the price ladder.

Ever pondered why this might be? Brokerage analysts, owing to their professional ties to the stocks they analyze, often cloak them in an optimistic aura. Our investigations reveal that for every “Strong Sell,” five “Strong Buys” are sung into the market winds, signaling a potential disconnect between analyst harmonies and the reality of stock movements.

Thus, rather than taking brokerage recommendations at face value, consider wielding them as a litmus test to validate your own research or to corroborate with a finer-tuned forecasting tool.

Zacks Rank, our in-house star-gazing tool with an outer-worldly verified performance history, steers through the stock galaxies by classifying them into five constellations, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). A reliable augur of a stock’s near-future performance, marrying ABR with Zacks Rank may chart a course towards a pot of investment gold.

Don’t Confuse Zacks Rank with ABR

Contrasting as night and day, Zacks Rank and ABR, despite both dancing within the 1-5 spectrum, waltz to entirely different tunes.

ABR tiptoes on brokerage recommendations, often adorned with fractions; on the other hand, Zacks Rank is a symphony of numerical mastery riding on the waves of earnings estimate revisions, showcased as whole numbers from 1 to 5.

While brokerage analysts might coat their recommendations in honeyed optimism, Zacks Rank leans on the raw data of earnings estimate revisions to paint a more accurate likeness of a stock’s future trajectory.

Additionally, Zacks Rank extends its hand uniformly across the vast ocean of stocks, applying its gradations alongside brokerage analysts’ current-year earnings prophecies. This balanced approach ensures that Zacks Rank maintains equilibrium among its five towering ranks.

Another pivotal contrast between ABR and Zacks Rank emerges in their timeliness. While ABR might languish in the past, Zacks Rank dances nimbly on up-to-the-minute earnings estimate revisions, offering a clear forecast of tomorrow’s stock horizons.

Is Newmont Corporation (NEM) a Treasure Trove for Investment?

In the realm of earnings estimates for Newmont, the Zacks Consensus Estimate for the current year has spurted by 8.1% over the past lunar cycle, settling at $2.64.

The harmonious crescendo of optimism among analysts, reflected in their synchronized elevation of EPS estimates, might serve as a beacon guiding the stock’s flight to higher altitudes in the coming spell.

With this recent crescendo in consensus estimates, embraced by three celestial factors linked to earnings predictions, Newmont shines at a Zacks Rank #2 (Buy). The stars align, inviting you to peruse the complete anthology of Zacks Rank #1 (Strong Buy) stocks here >>>>

Hence, the ABR akin to a buy signal for Newmont might serve as a sympathetic guide for embarking on the shores of investment ventures.

Zacks Names “Single Best Pick to Double”

From a sea of stocks, five Zacks visionaries have each cast their gaze on a magnanimous star, shooting for the skies with the potential to ascend +100% or further within the coming months. Among these five beacons, Director of Research Sheraz Mian plucks one radiant contender destined for the loftiest ascent of them all.

A humble chemical luminary, aglow with a 65% leap in the past solar cycle, poised on the cusp of an economic supernova. Riding the celestial winds of soaring 2022 earnings predictions and armed with a war chest of $1.5 billion for stock repurchases, this hidden gem beckons retail investors to step forth at any moment.

This celestial orb might rival or surpass the stellar trajectories of past Zacks’ Celestial Conquerors like the Boston Beer Company, soaring +143.0% in just over nine moons, and NVIDIA, exploding with +175.9% over the past annual journey.

Free: Behold Our Leading Star and its Four Guiding Constellations >>

Unearth the Mysteries of Newmont Corporation (NEM) with Our Free Stock Analysis Report

For further enlightenment, peruse this treatise on Zacks.com right here.