Amidst the storm clouds of market volatility and economic uncertainty, investors often seek solace in the stable haven of dividend-yielding stocks. These stalwart companies, with robust free cash flows, bestow upon their shareholders bountiful dividends as a token of appreciation for their loyalty.

For those navigating the treacherous waters of the market, staying informed is key. What better way to arm oneself than by perusing the latest insights from Wall Street’s finest analysts? By sifting through expert opinions, traders gain valuable perspectives on their chosen stocks, steering them towards success.

Let’s delve into the realm of high-yielding stocks in the financial sector, as illuminated by the discerning eyes of Wall Street’s sharpest minds.

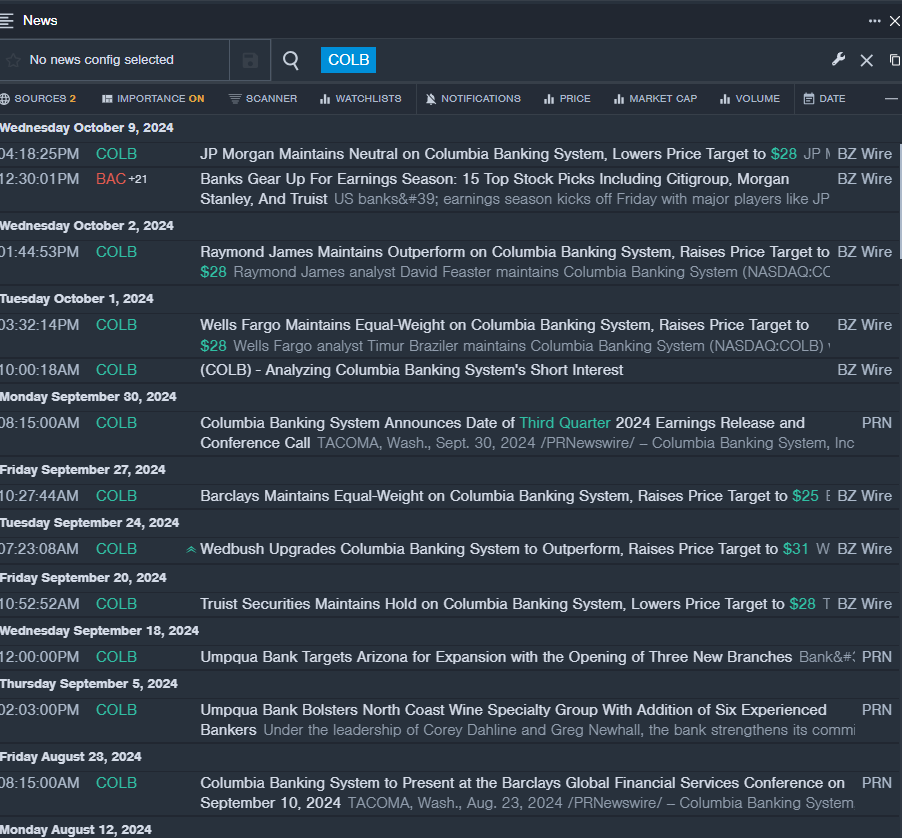

Columbia Banking System, Inc. COLB

- Dividend Yield: 5.19%

- Analysis:

- JP Morgan analyst Steven Alexopoulos maintained a Neutral rating, tweaking the price target from $29 to $28 on Oct. 9. This adept analyst boasts an impressive 71% accuracy rate.

- Raymond James analyst David Feaster remained bullish with an Outperform rating, elevating the price target from $26 to $28 on Oct. 2. With a commendable 68% accuracy rate, this analyst’s vision is one to heed.

- Key Development: Columbia Banking System is set to unveil its third-quarter financial results on Thursday, Oct. 24, at the crack of dawn, eager to unveil its financial prowess to the world.

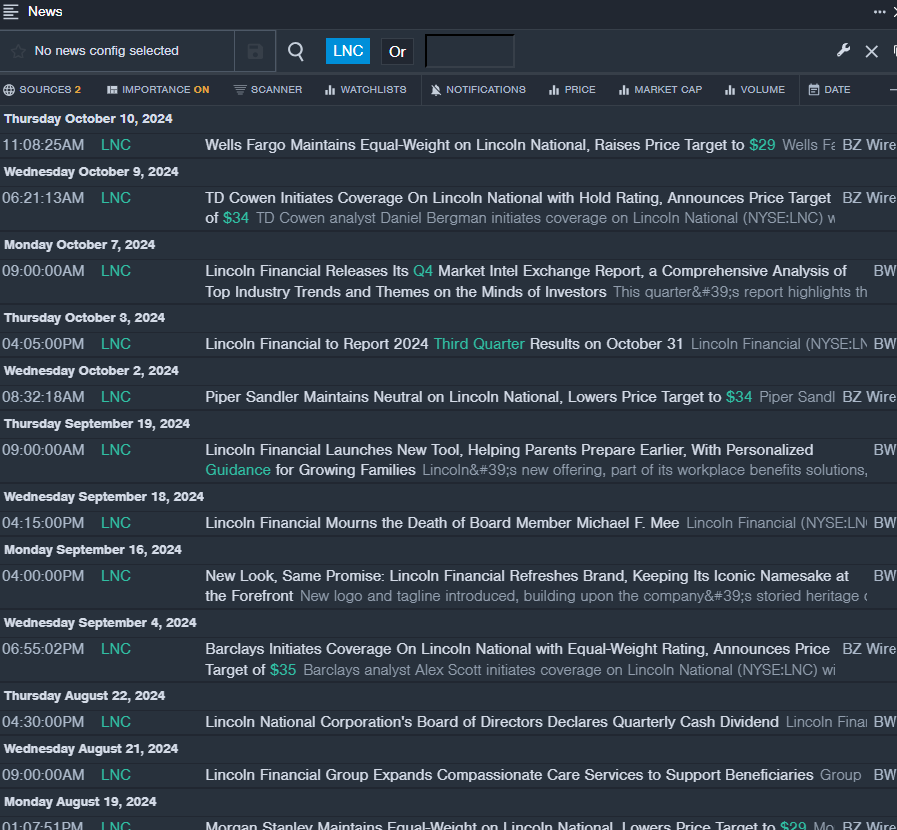

Lincoln National Corporation LNC

- Dividend Yield: 5.35%

- Analysis:

- Wells Fargo analyst Elyse Greenspan stood pat with an Equal-Weight rating but nudged the price target from $28 to $29 on Oct. 10. With a 68% accuracy rating, this analyst’s insights are a beacon in the vast ocean of financial analysis.

- TD Cowen analyst Daniel Bergman jumped into the fray, initiating coverage with a Hold rating and setting a price target of $34 on Oct. 9. Despite being a newcomer, this analyst displays a formidable 66% accuracy rate.

- Key Development: Lincoln Financial is poised to unveil its third-quarter results on the hauntingly auspicious date of Oct. 31, offering investors an exciting glimpse into its financial performance.

Main Street Capital Corporation MAIN

- Dividend Yield: 7.86%

- Analysis:

- Morgan Stanley analyst Devin McDermott performed a daring upgrade, shifting the stock from Underweight to Equal-Weight with a price target of $24 on Sept. 16. With an impressive 80% accuracy rate, this analyst’s foresight is a force to reckon with.

- Barclays analyst Theresa Chen kept the ship steady with an Equal-Weight rating, elevating the price target from $21 to $22 on Sept. 13. With a robust 78% accuracy rate, this analyst provides a steady hand in turbulent times.

- Key Development: On the fateful day of Oct. 15, Main Street unveiled a preliminary estimate of third-quarter net investment income, ranging from 99 cents to $1.01 per share, igniting excitement among its faithful investors.

Seeking more enlightenment on financial matters? Stay tuned for further revelations!