Investing in high-quality companies with consistent earnings growth is akin to planting seeds that blossom into towering money trees, enriching your investment portfolio with bountiful returns over time. A diversified portfolio is the bedrock of financial security, shielding investors from unexpected market volatility. Nonetheless, identifying stocks with unprecedented growth potential can be the game-changer that elevates your financial standing.

Amazon: Soaring High on E-Commerce and Cloud Dominance

Embarking on its humble journey by retailing books online, Amazon (NASDAQ: AMZN) has metamorphosed into an e-commerce behemoth, capturing a 38% market share in the United States. Its subsidiary, Amazon Web Services, reigns as the global cloud infrastructure front-runner with a commanding 31% market share.

The rags-to-riches saga of Amazon exhibits stellar long-term growth potential. A $10,000 investment made in Amazon’s nascent stage could have burgeoned to over $18 million today. While Amazon’s current valuation nears $2 trillion, room for exponential growth still exists. E-commerce constitutes a mere 16% of total retail in the United States, signaling vast expansion prospects. Moreover, the burgeoning artificial intelligence domain augurs well for Amazon, fortifying its cloud computing prowess.

AMZN Price to CFO Per Share (TTM) data by YCharts. CFO = Cash flow from operating activities, (aka, operating cash flow).

Despite its colossal stature, Amazon’s current valuation remains attractive, with shares trading at historically reasonable levels. This stalwart continues to exhibit promising growth trajectories, making it a compelling addition to any long-term investment strategy.

Netflix: Trailblazing the Streaming Terrain

Charting uncharted waters and revolutionizing industries is no mean feat. Netflix (NASDAQ: NFLX), the trailblazing streaming service, has ascended to the apex of global streaming, boasting over 270 million paid subscribers as of Q1. The company’s exponential membership growth of 16% year-over-year underscores the paradigm shift from traditional cable TV to streaming platforms.

Amid its exalted status, Netflix leverages various growth levers to propel earnings expansion. Beyond expanding its subscriber base, Netflix can bolster profits through price hikes, combatting password sharing, and venturing into novel content and media forms. Dabbling in live sports content and cloud-based game streaming exemplifies Netflix’s diversified growth strategies.

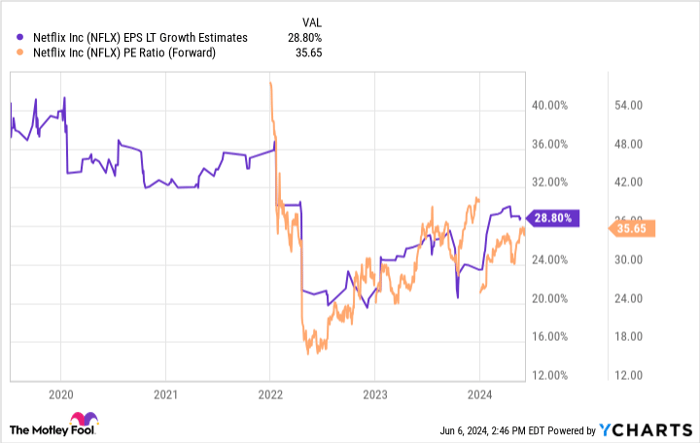

NFLX EPS LT Growth Estimates data by YCharts.

Boasting a decade of outperformance in the market, Netflix remains poised for sustained earnings growth. Trading at 35 times earnings, analysts forecast an annual profit surge exceeding 28% over the next three to five years, rendering the stock appealing to investors eyeing robust returns.

Investing Wisdom: The Path to Amazonian Wealth

Embarking on an investment journey with Amazon entails meticulous consideration:

The Motley Fool Stock Advisor team recently unveiled the 10 best stocks offering tantalizing growth prospects, with Amazon notably absent. This curated selection holds the promise of prodigious returns in the foreseeable future.

Reflect on the transformative potential of early investments highlighted by Stock Advisor, such as Nvidia in 2005. A meager $1,000 investment back then could have blossomed into a staggering $740,688*, underscoring the latent wealth awaiting astute investors.

Stock Advisor furnishes investors with a blueprint for success, navigating the investment terrain with expert guidance and two monthly stock picks. Delivering returns surpassing the S&P 500 fourfold since 2002*, the service remains an alluring beacon for discerning investors.

*Stock Advisor returns as of June 3, 2024