The Mag 7 group has commanded attention in the financial sphere over the past year, engaging investors with their impressive performance and consistent quarterly results that have set the market abuzz.

Recent weeks have witnessed heightened interest in three prominent members of this exclusive club – namely Nvidia NVDA, Apple AAPL, and Amazon AMZN. This surge in search activity signifies a growing curiosity among investors eager to delve deeper into these companies. Given their current market prominence, an insightful examination of their current standing is imperative.

Insight into Nvidia

Investor darling Nvidia has encountered some challenges amidst a broader slowdown in the AI sector. Nevertheless, with a remarkable 130% surge in share value year-to-date, the company continues to exhibit a positive earnings outlook across various metrics.

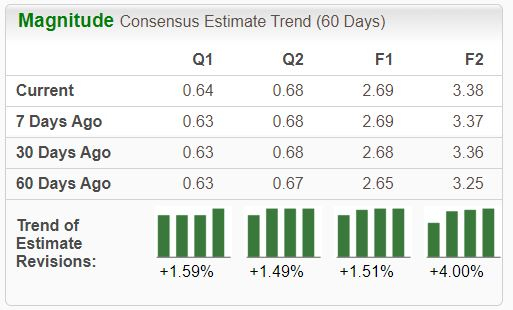

Image Source: Zacks Investment Research

The expected earnings of $2.69 per share for the current year mark a significant 100% year-over-year increase, with sales also forecasted to surge by 90%. Nvidia’s exceptional sales growth is primarily attributed to the relentless demand for chips essential for AI applications.

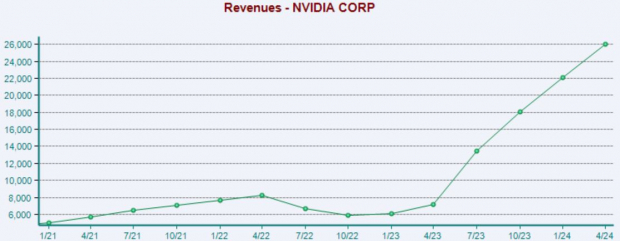

Refer to the chart below for a visual representation of the company’s quarterly sales.

Image Source: Zacks Investment Research

The Latest from Apple

Apple’s stock faced scrutiny earlier in 2024 due to a slow start but has regained momentum recently, boasting a 14% year-to-date upsurge. Concerns regarding China and AI competitiveness initially weighed on performance, but the latest quarterly results have injected optimism post-earnings.

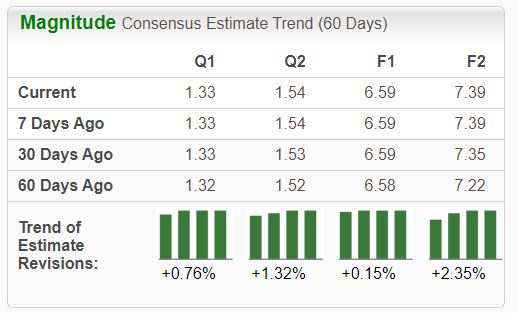

The stock holds a Zacks Rank #2 (Buy), with expectations of enhanced earnings performance across the board.

Image Source: Zacks Investment Research

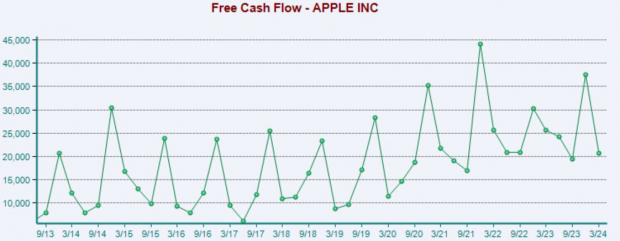

Apple’s strong cash-generating capacity has facilitated consistent dividend growth, with the company recently celebrating its 12th consecutive year of increased payouts. While the annual yield stands at a modest 0.5%, the firm’s steadfast 4.9% five-year annualized dividend growth underscores its dedication to rewarding shareholders.

Notably, free cash flow amounted to $20.7 billion in the latest reporting period.

Image Source: Zacks Investment Research

Amazon’s Positive Trajectory

Amazon shares have witnessed a positive upswing in 2024, fueled by favorable quarterly results showcasing a renewed acceleration in AWS performance. Holding a promising Zacks Rank #2 (Buy), AMZN demonstrated robust operational prowess in its recent financial period.

The company achieved an operating income of $15.3 billion, marking a 220% increase from the corresponding period last year’s $4.8 billion. Particularly noteworthy was AWS’s stellar performance, with net sales of $25 billion reflecting a 17% year-over-year growth and breaking a streak of recent negative surprises in that domain.

Amazon’s outlook for the current fiscal year remains bright, with the Zacks Consensus EPS estimate of $4.59 indicating a substantial 60% year-over-year earnings growth.

Image Source: Zacks Investment Research

The Bottom Line on the Mag 7 Trio

The trio of Nvidia NVDA, Apple AAPL, and Amazon AMZN have retained their prominence within investors’ consciousness, occupying esteemed positions in the revered Mag 7 group.

Despite recent market pressures, the fundamentals of these companies remain robust, with positive outlooks reinforcing their resilience. The recent downturn can be attributed to profit-taking following remarkable uptrends, compounded by the concurrent strength observed in small-cap stocks, which have exerted a drag on their performances.

Zacks’ Top 3 Hydrogen Stocks

Demand for clean hydrogen energy is projected to reach $500 billion by 2030, with further growth forecasted to increase fivefold by 2050. Zacks has identified three diversified giants poised to lead the charge towards becoming hydrogen powerhouses.

One has outperformed the market over the past 25 years with a remarkable rise of +2,400% to +380%.

Another has already secured capital commitments amounting to $15 billion for low-carbon hydrogen products through 2027 alone.

Our third pick achieved 52-week highs in Q4 2023 and has consistently raised its dividend annually for over a decade.