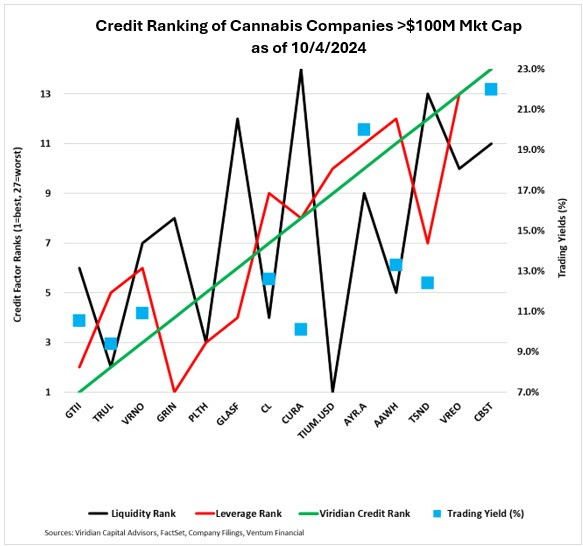

Anticipation is building as Florida prepares for a crucial vote on recreational cannabis, setting the stage for investors to seize significant opportunities in the market. The highly regarded Viridian Credit Tracker has identified AYR Wellness (AYRWF) as a standout – a company with a robust 20% yield and a strong foothold in Florida’s burgeoning cannabis sector. The impending decision by Florida voters on recreational cannabis could propel AYR to new heights, making it a compelling option for investors eyeing a potential windfall.

AYR Wellness Offers 20% Yield: A Gateway to Florida’s Potential

According to the Viridian Credit Tracker curated by Viridian Capital Advisors, AYR stands out due to its extensive exposure to Florida’s cannabis market. With a remarkable 20% trading yield, AYR surpasses many competitors in the field. Should Florida pave the way for recreational cannabis, AYR’s valuation is poised to skyrocket, positioning this stock as a strategic buy for investors anticipating the upcoming vote.

Cresco Labs vs. Curaleaf: Unveiling a 250 Basis Point Differential

An intriguing recommendation from the report suggests investors consider a pair trade involving Cresco Labs (CRLBF) and Curaleaf (CURLF). By buying Cresco Labs with a 12.6% yield and selling Curaleaf at 10.1%, investors could potentially secure a 250 basis point yield advantage. This move is substantiated by Cresco’s robust financials and credit performance, offering investors a pathway to higher returns and enhanced credit stability.

TerrAscend: Evaluating a 12% Yield and Its Implications

Conversely, TerrAscend (TRSSF) presents a cautionary tale with its 12% yield, warranting a recommendation to sell. Despite its significant presence in the cannabis industry, TerrAscend’s comparatively lower yield and limited exposure to Florida’s growth prospects render it less appealing in comparison to AYR. Investors are advised to proceed with caution when contemplating investments in TerrAscend.

Cannabist Faces Liquidity Challenges: The Weakest Credit

While opportunities abound in the cannabis market, it’s essential to acknowledge the liquidity concerns surrounding Cannabist (CCHWF), which holds the weakest credit rating in the group. Recent asset sales have exacerbated these concerns, potentially limiting Cannabist’s upward trajectory in the near term despite prospects for future improvement.

Seizing Opportunities Before Florida’s Potential Game-Changer

With the landscape of Florida’s cannabis market on the brink of transformation, investors are advised to consider a strategic pair trade: acquire AYR at 20%, divest from TerrAscend at 12%, and explore the prospects of Cresco Labs at 12.6% relative to Curaleaf at 10.1%. The impending vote in Florida looms large, heralding the potential for substantial returns for savvy investors who position themselves strategically ahead of this pivotal event.

Investors are encouraged to act swiftly as the impending vote in Florida has the potential to reshape the cannabis investment landscape dramatically. Stay informed, stay alert, and be prepared to capitalize on the unfolding opportunities as the market dynamics evolve.

Read Next: SEC Charges ‘Magic Mushroom’ Co. Minerco In $8M Pump-And-Dump Scheme