The Concept of Censorship Resistance

Bitcoin, as a decentralized digital currency, boasts the feature of being censorship resistant. This means that any transaction, no matter the circumstance, can eventually find its way into the blockchain as long as the sender is willing to pay an adequate transaction fee. Rather than being entirely immune to censorship, the key reality is that individual miners have the capability to censor certain transactions from their blocks but cannot prevent other miners from including those transactions in their own blocks.

So what mechanisms are in play to ensure Bitcoin’s resilience against censorship and what implications do they carry?

Market Dynamics and Fee Saturation

When a group of miners decides to censor a specific type of transactions, it leads to a reduction in blockspace available to those transactions, resulting in a higher fee pressure. For instance, if there are regular transactions and a set of “verboten transactions” being censored, the latter face fee saturation at a much faster rate than the former. This scenario creates an uneven distribution of fee revenue amongst different miners, propagating an unsustainable imbalance in the system.

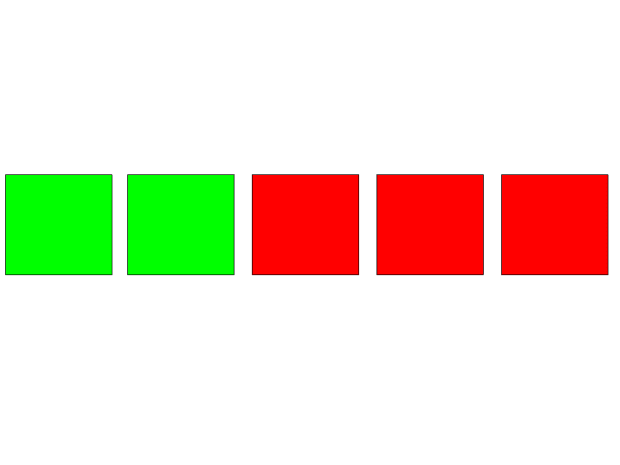

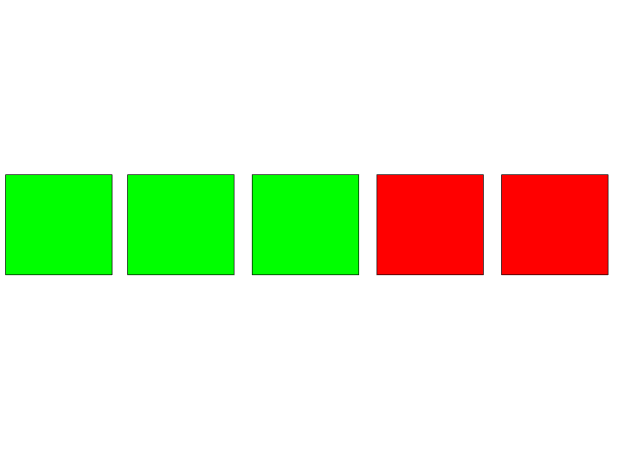

These market dynamics dictate that the green miners (who include verboten transactions) would earn more revenue than the red miners (who censor them), ultimately setting off a cascade of events either through reinvestment or defection that would lead to a rebalancing of the fee revenue across the network.

Hashrate Growth and Equilibrium

This disequilibrium drives a growth in the hashrate of the green miners, eventually leading to an equilibrium where both groups of miners make a comparable income. When verboten transactions’ demand for blockspace exceeds the available supply, this dynamic of green miners earning more until they achieve a balance of fee revenue continues to perpetuate.

And it is this self-correcting mechanism that underpins the censorship resistance of Bitcoin. Market dynamics elegantly align the incentives of miners, ensuring that even if some nodes attempt to censor certain transactions, economic forces make it advantageous for others to include them.