At the whims of the market, shares of the illustrious electric-vehicle (EV) producer, Rivian (NASDAQ: RIVN), took a nosedive last month resonating the broader downturn in the EV industry. The company faced a barrage of challenges, from fierce competition with other EV manufacturers slashing prices to bleak financial results and deliveries from the trailblazing behemoth, Tesla.

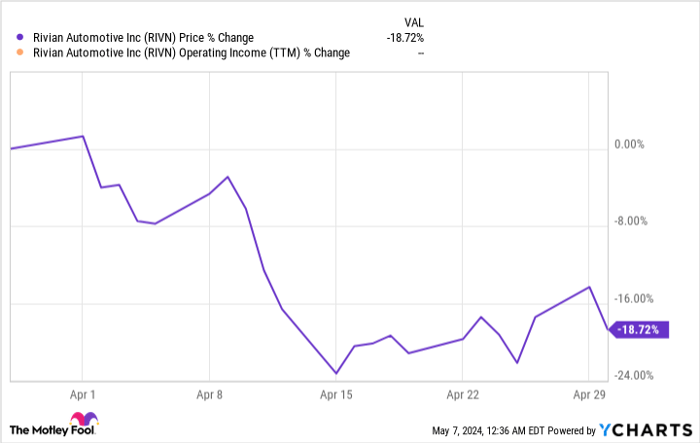

According to the data unveiled by S&P Global Market Intelligence, Rivian’s stock plunged by a staggering 19% in April, mainly succumbing to the bearish trend prevalent in the first half of the month.

Heading Downhill for Rivian

April kickstarted with Rivian sliding downhill as the company published delivery figures that met guidance while reiterating its production outlook of 57,000 vehicles for the year. The company disclosed that it managed to deliver 13,588 vehicles in the first quarter, which, though in line with expectations, fell short of investors’ anticipations for an upward revision in guidance.

Meanwhile, Tesla unveiled a 9% dip in its first-quarter earnings, highlighting the feebleness lurking in the broader EV realm.

The second week of April spelled trouble for Rivian when Ford Motor announced price cuts for the F-150 Lightning EV, heightening the price rivalry with Rivian, as both companies emerge as prominent players in the EV pickup segment.

Furthermore, the release of the March Consumer Price Index on April 10 unveiled a surge in inflation levels, extinguishing hopes of an interest rate cut by the Federal Reserve later in the year. The anticipation of reduced interest rates fueling demand for luxury cars seems to have fizzled out, posing a challenge for high-end car manufacturers like Rivian.

On April 17, Rivian declared a 1% reduction in its workforce, marking a step in its ongoing journey to trim down its colossal losses.

Image source: Rivian.

Forecasting Rivian’s Trajectory

Investors brace themselves for a significant update from Rivian post-market hours on Tuesday, anticipating the full first-quarter earnings release.

Despite the hope for stellar outcomes driving a potential stock resurgence, Rivian faces looming uncertainties as its production expansion decelerates amidst a seemingly stagnant EV domain.

Analysts project a 76% surge in revenue to $1.16 billion and a loss per share of $1.17, as opposed to $1.25 from the corresponding quarter last year. However, a mere beat might not suffice to propel the stock upwards, with investors yearning to witness progress towards gross profitability.

Investing in Rivian Automotive: Yay or Nay?

Before diving into Rivian Automotive stock, ponder on this:

The Motley Fool Stock Advisor analyst team identified what they deem the 10 best stocks for investors to dive into now, with Rivian Automotive conspicuously absent from the list. The highlighted stocks are poised to generate substantial returns in the years to come.

Reflect on the instance when Nvidia made this list on April 15, 2005 – an investment of $1,000 at our recommendation would have blossomed into $544,015!

Stock Advisor furnishes investors with a user-friendly roadmap to success, complete with portfolio development guidance, regular analyst updates, and two fresh stock picks each month. The service has surpassed the S&P 500’s returns fourfold since 2002.

*Stock Advisor returns as of May 6, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.